Retirement Realities – What Every Canadian Needs To Know To Secure Their Future

Most Canadians underestimate the complexities of planning for their retirement, often leading to financial insecurity during their golden years. Understanding your retirement savings options, potential healthcare costs, and the impact of inflation is important to ensure a comfortable lifestyle. With the right strategies and knowledge, you can navigate these challenges and make informed decisions that will secure your future. This blog post will provide you with vital insights and actionable steps to help you prepare effectively for a financially stable retirement.

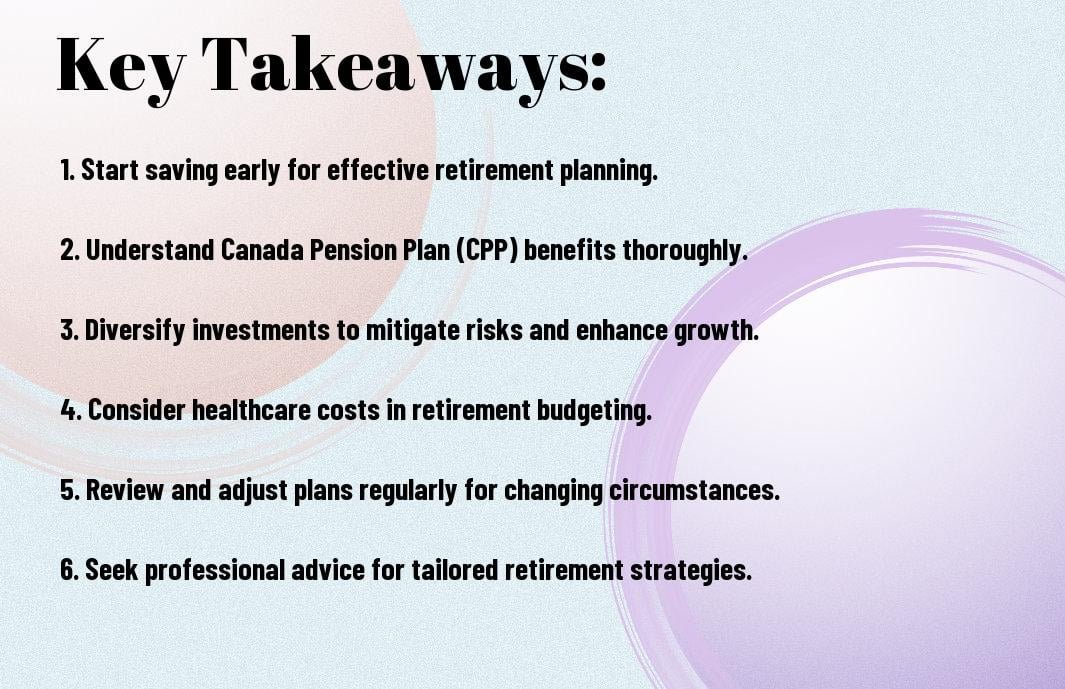

Key Takeaways:

- Financial Planning: It’s crucial to develop a comprehensive financial plan that considers income sources, expenses, and investment strategies for a stable retirement.

- Government Benefits: Understand the various government programs available, such as CPP and OAS, and how they can contribute to your retirement income.

- Health Care Costs: Anticipate rising health care expenses in retirement and plan accordingly to ensure you are financially prepared for medical needs.

Understanding Retirement Savings

The key to a secure retirement lies in effective savings strategies. By understanding the various options available, you can tailor a plan that meets your unique financial Needs.

Types of Retirement Accounts

The following are the main types of retirement accounts available to you:

| RRSP | Registered Retirement Savings Plan |

| TFSA | Tax-Free Savings Account |

| Pension Plans | Employer-sponsored savings plans |

| RESP | Registered Education Savings Plan |

| RDSP | Registered Disability Savings Plan |

Any of these accounts can play a crucial role in building your retirement fund.

Government Pension Plans (CPP/QPP)

Types of government pension plans include the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP). These programs provide monthly income to eligible retirees, based on their contributions throughout their working years. You should be aware that the amount you receive can significantly impact your overall retirement savings.

Plans like the CPP and QPP are designed to ensure that you have a basic income during retirement. It’s crucial to contribute regularly, as your monthly payouts depend on your work history and contributions. The advantages of these plans are clear, as they provide a predictable source of income; however, it is crucial to note that relying solely on these plans may fall short of fulfilling your comprehensive retirement goals. Always consider supplementing them with additional savings and investments for a comfortable future.

Estimating Retirement Expenses

If you want to secure your financial future, it’s crucial to accurately estimate your retirement expenses. Begin by assessing your current spending habits and envision how they might change in retirement. Factors like travel, hobbies, and housing can influence your budget significantly. For more insights, consider visiting Retiring soon?

Cost of Living Considerations

On average, the cost of living can vary greatly depending on where you live in Canada. It’s important to factor in housing, utilities, and food, as these can fluctuate over time. Make sure to assess your community’s cost of living, as it may affect your retirement savings and lifestyle choices significantly.

Health Care and Insurance Needs

One crucial aspect to consider in your retirement planning is your health care and insurance needs. As you age, you may require more medical care or prescription medications, which can be costly.

For instance, it’s vital to recognize that long-term care might become a necessity, which can put a serious strain on your finances if not planned for. Additionally, while provincial health care plans cover many crucial services, you may still face significant out-of-pocket expenses for drugs, specialist visits, and supplemental insurance. Therefore, researching and investing in comprehensive health care insurance can help ensure your financial stability during retirement.

Investment Strategies for Retirement

To secure your retirement, it’s crucial to adopt effective Planning for Retirement in Canada: Secure Your Future Today! investment strategies. Diversifying your portfolio across various asset classes can help you mitigate risks while aiming for growth. Consider your financial goals, market conditions, and time horizon as you craft a strategy that aligns with your retirement vision.

Risk Tolerance and Asset Allocation

Any effective investment strategy begins with understanding your risk tolerance and determining your asset allocation. Assessing how much risk you are willing to take on will help you decide how to split your investments between stocks, bonds, and other assets, allowing you to tailor a strategy that suits your comfort level while aiming for optimal growth.

Short-term vs. Long-term Investments

An vital aspect of retirement investing is distinguishing between short-term and long-term investments. While short-term investments can offer quicker access to cash, long-term investments typically provide greater potential for growth to help you achieve your retirement goals.

The differences between short-term and long-term investments can significantly impact your retirement planning. Short-term investments, such as cash accounts or bonds, are ideal for immediate liquidity but may have lower returns. In contrast, long-term investments, including stocks and real estate, often deliver higher returns over time, but come with greater risks. Understanding the balance between these options is vital; while long-term investments can provide substantial gains, they also require you to tolerate market fluctuations. Therefore, it’s vital to align your investment choices with your specific retirement timeline and financial objectives.

Managing Debt Before Retirement

Now is the time to take a close look at your debt situation as you near retirement. Reducing or eliminating debt can significantly impact your financial security and peace of mind during your golden years. By prioritizing debt management, you can enhance your cash flow, allowing for a more comfortable and worry-free retirement experience. Keep in mind, the less debt you carry into retirement, the more resources you’ll have available to enjoy life after work.

Strategies for Paying Off Debt

For many approaching retirement, adopting effective strategies for paying off debt is crucial. Consider methods like the debt snowball or avalanche techniques, which can help you systematically pay down outstanding balances. Additionally, explore consolidating high-interest debt into lower-interest loans or seeking professional financial advice to create a personalized pay-off plan that fits your budget and circumstances.

Importance of Good Credit

To secure your financial future, maintaining good credit is crucial as you prepare for retirement. A strong credit score plays a vital role in reducing borrowing costs and enhancing your financial opportunities, such as qualifying for favorable loan terms or securing rental properties.

This emphasis on good credit enables you to access better interest rates, which means you’ll save money when you need to borrow. Additionally, a solid credit history aids in obtaining necessary loans, ensuring you can adapt to unforeseen expenses in retirement. Maintaining or improving your credit not only provides financial flexibility but also contributes to your overall financial well-being. Keep in mind, achieving high credit scores can alleviate stress and pave the way for a more stable retirement.

The Impact of Inflation on Retirement

Unlike your pre-retirement years, inflation can significantly erode your purchasing power during retirement. Rising costs mean that the same amount of money will buy you less over time, making it crucial to factor inflation into your retirement planning. You need to ensure your savings and investments can keep pace with or outpace inflation to secure your standard of living in the future.

Understanding Inflation Rates

The inflation rate measures the annual percentage increase in the cost of goods and services, directly impacting your retirement finances. It’s crucial to keep an eye on trends in inflation rates as they can vary significantly, affecting how far your savings will stretch. By understanding these rates, you can better plan for the future and ensure that your retirement income maintains its value.

Strategies to Hedge Against Inflation

Inflation protection is critical to ensuring your retirement savings maintain their value. You can consider investing in assets that traditionally outperform inflation, such as real estate and stocks. Additionally, consider increasing your exposure to inflation-linked bonds or commodities that typically appreciate in value during inflationary periods.

Inflation can erode your retirement savings if not effectively managed. Diversifying your investment portfolio with assets such as real estate, stocks, and commodities can serve as a hedge against rising costs. It’s also wise to include inflation-protected securities in your portfolio. Regularly reassessing your financial strategy allows you to adjust to changing inflation rates, ensuring your retirement income maintains its purchasing power over time. Recall, staying informed and proactive is key to securing your financial future as inflation continues to rise.

Creating a Retirement Plan

All Canadians should take the time to develop a comprehensive retirement plan that addresses their unique financial situation, lifestyle goals, and desired retirement age. Understanding your current finances, including savings, investments, and debts, is crucial in establishing a realistic retirement strategy that will ensure you continue enjoying life without financial stress.

Setting Financial Goals

With clear financial goals, you can better focus your retirement planning efforts. Start by assessing your current income, expenses, and savings to determine how much capital you’ll need to maintain your desired lifestyle post-retirement. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals will provide a solid foundation for your retirement plan.

Timeline for Retirement Preparation

Preparation for retirement should begin well before your target retirement age, ideally in your 20s or 30s. Assess how many years you have until retirement to calculate how much you need to save each month. Creating checkpoints at different life stages can help you adjust your strategy, ensuring you stay on track for a secure financial future.

For instance, if you plan to retire at 65, begin your preparation early by maximizing contributions to your retirement accounts in your 20s. This allows your investments to grow exponentially over time, taking advantage of compound interest. By your 40s, reassess your financial situation and possibly increase your savings rate to account for any shortfalls. Re-evaluating at your 50s can help solidify your strategy, ensuring that you are well-prepared and confident to enjoy your retirement years.

Final Words

On the whole, understanding retirement realities is crucial for every Canadian looking to secure their financial future. You need to assess your savings, consider healthcare costs, and be aware of government benefits that could aid your retirement. It’s important to plan ahead, make informed decisions, and regularly review your financial strategy to ensure you are on track. By being proactive and seeking advice when necessary, you can navigate the complexities of retirement with confidence and peace of mind.

FAQ

Q: What are some key factors Canadians should consider when planning for retirement?

A: When planning for retirement, Canadians should consider several key factors including their expected retirement age, lifestyle choices during retirement, sources of retirement income (such as CPP, OAS, and personal savings), inflation, healthcare costs, and potential tax implications. It’s important to develop a comprehensive plan that includes budgeting for necessary expenses and allocating savings into various investment vehicles to ensure a sustainable income stream throughout retirement.

Q: How can Canadians maximize their retirement savings?

A: Canadians can maximize their retirement savings by contributing regularly to tax-advantaged accounts such as the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA). Employers may also offer pension plans or group RRSPs, which can help grow savings through matched contributions. It’s advisable to take advantage of employer matches and set savings goals based on future income needs, and to also consider diversifying investments to balance risk and growth potential.

Q: What are the potential risks that could impact retirement plans for Canadians?

A: Several potential risks could impact retirement plans for Canadians, including market volatility, unexpected medical expenses, longevity risk (outliving one’s savings), inflation eroding purchasing power, and changes in government policies affecting pensions and benefits. It’s important for Canadians to regularly reassess their retirement plans, including adjusting investment strategies and savings rates, and to include contingency plans to mitigate these risks effectively.