Posts by AdminRFinc

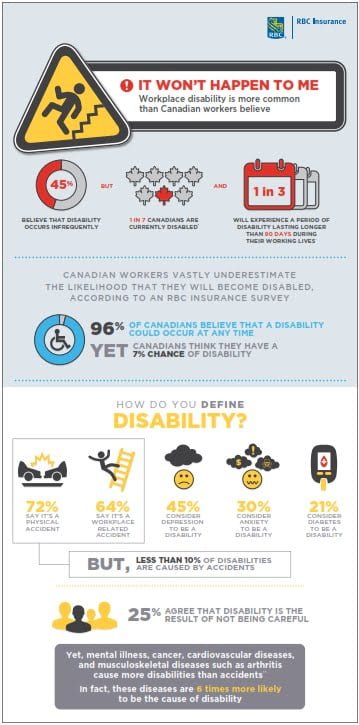

IT WON’T HAPPEN TO ME!

Where do you get your financial and life insurance advice?

Everyone has that uncle, or best friend, who has a hot stock tip or who can get you in on the ground floor of the latest thing since the iPod. Are they right? Will they help make you financially secure? Maybe. But are you willing to risk your financial future on it? If you’re like…

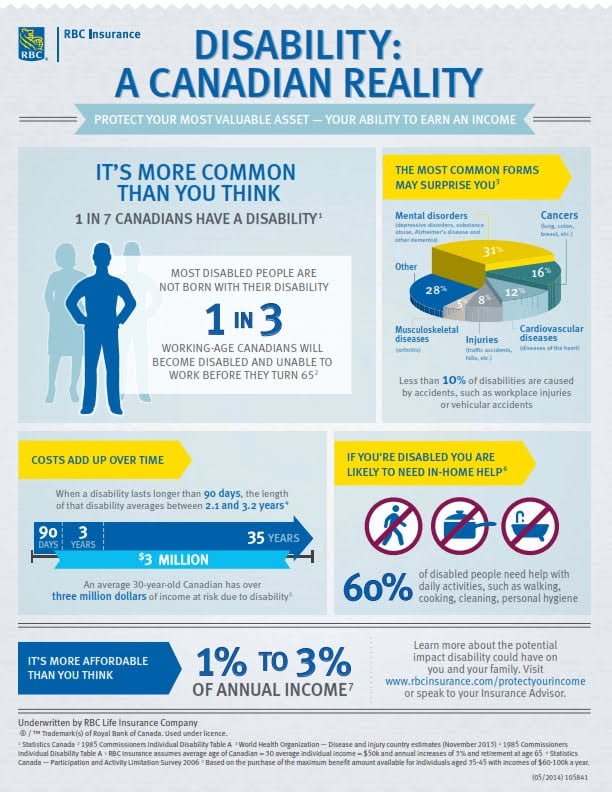

Read MoreDISABILITY: A CANADIAN REALITY

Do you need critical illness insurance?

Recovering from a serious illness can come at a significant cost. If it happens to you, how will you pay for it? Imagine this: You’ve just been diagnosed with cancer. While your doctors say your chances of a cure are good, the weeks and months of treatment and recovery you’ll need can come at a…

Read MoreCANADIANS OFF WORK DUE TO A DISABILITY FACE A PERFECT STORM

Why naming a beneficiary should not be considered a “once and done” event

Let’s talk about…the importance of naming a beneficiary for your life insurance policy In Canada, after you pass away, the proceeds of your estate can take one of two routes. Proceeds can pass seamlessly from you to your loved ones or they can enter the probate system. The probate system can take a lot of…

Read More4 guaranteed investment products you should know about

By Jo Coughlin brighterlife.ca Thanks to good nutrition and medical advances, Canadians are living longer than ever before. But will our savings last as long as we do? Today, many of us can expect to live into our 80s, 90s, and some us even into our 100s. . . When you add up today’s long…

Read MoreLet’s talk about…critical illness

ivari can help you and your family keep the “quality” in quality of life should you be diagnosed with a critical illness. Critical illness insurance from ivari provides a tax-free,*(1) lump-sum benefit upon diagnosis of a covered condition as defined in your contract. You can use the benefit payment however you choose, without restriction. Let’s…

Read More10 Misconceptions About Life Insurance

Posted by ALLISON BARTON – Empire Life Insurance with Care Blog Why do some consumers have so many misconceptions about life insurance? People seldom like to consider their own mortality and life insurance is rarely a topic of conversation. However, understanding the benefits of life insurance can help you plan for the future so life…

Read MoreLife insurance: Term, permanent – or both?

By Dave Dineen – Brighterlife.ca Understanding the difference between permanent and term life insurance will help you choose the protection you need – and prevent regrets in the future. How would you feel 20 to 30 years after buying a product that has done exactly what it was supposed to do? Pretty good, right? No…

Read More