Posts

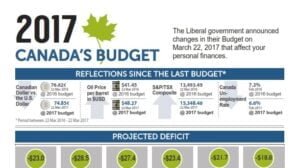

The new Liberal government announced changes in their budget in March, 2017 that affect your personal finances. PDF Version

Client Relationship Model, Phase 2 (CRM2) is an industry-wide regulatory initiative mandated by the Canadian Securities Administrators (CSA). What is CRM2? CRM2 is an industry-wide regulatory initiative that the Canadian Securities Administrators (CSA) have mandated under National Instrument 31-103. Starting in July 2014 and over the next two years, a number of changes will be…

An option to consider – the Corporate Insured Retirement Program with Corporate Borrowing With this financial planning strategy, your corporation deposits funds into a permanent life insurance policy in excess of the amount required to cover the insurance and other policy costs. In the future, your corporation assigns the policy to the bank as collateral…

By Kim Armstrong – sunlife.ca Job insecurity doesn’t have to mean financial insecurity. These 5 tips will help you improve your financial health and plan for a brighter future. Sophia Erikson is a 26-year-old who, for the past 2 years, has had to live away from her family and friends, moving from one contract job…

You have a retirement plan set out and it includes your RRSP. Could a health interruption get in the way of your plan? If you need to withdraw money from your RRSP, not only can it affect your RRSP’s growth, it’s considered taxable income. In fact for every $1.00 you need, you’ll have to withdraw $2.00, based…

By Susan Yellin In 2017, the venerable registered retirement savings plan (RRSP) turns 60. Like any 60-year-old, the RRSP has its strengths and weaknesses. Happy birthday, RRSPs. Introduced in 1957 (even before the Canada Pension Plan), registered retirement savings plans (RRSPs) were devised as and continue to be a way for Canadians who don’t…

Here is a simple example to help explain. Joe: Annual Salary: $50,000 Income Tax Paid: – $11,036 After-Tax Income: $38,964 An allowable RRSP contribution can be deducted From your income. In other words your income will be lower when calculating how much income tax you owe for the year. If your income is…

By Brenda Spiering birghterlife.ca Can you imagine what would happen if you died and your beneficiaries didn’t know where to find your will? Or your money? It happens all the time according to Jim Yih, author of the personal finance blog, retirehappy.ca: “When someone dies, there are a whole bunch of questions that need answers…

frameborder=”0″ allowfullscreen