Wealth Management

The alarming headlines of 2017 might be tempting investors to take drastic action. But it’s smarter to take a deep breath and a longer view. For Canadian investors, 2017 has provided plenty of potential worries, with an erratic U.S. president given to Twitter eruptions being arguably the largest. The real danger for investors is that…

By Sheryl Smolkin – Sunlife.ca As retirement nears, the focus changes from building your nest egg to converting it into income. But how can you avoid outliving your money? This is a vital concern, particularly when you’re looking at 30 or more years of retired life. Drawing down the capital and investment return from a…

Laying a sound foundation for retirement income involves careful planning. Where do you start? In this segment of Life & Money Matters Peter shares eight simple steps to help you get started on your retirement future. Transcript: Where do I Start With Retirement Income Planning Life & Money Matters

By Louise Armstrong – Foresters Blog Do you have an estate? Many people think they don’t but if you have assets, then you have an estate. It’s made up of everything you own including your home, your life insurance policies, your investments and even the brooch that was passed down to you from great Aunt Ethel.…

Does your retirement reality fit your own vision and experiences? In this video, Peter demystifies the commonly held perceptions about retirement among boomers and younger generations. Transcript: Retirement Realities for Boomers Life & Money Matters

By Deanne Gage – sunlife.ca If you want to achieve your financial goals, what you do is only part of the story. What you don’t do is just as important. Want to meet your financial planning* goals with few issues? To increase your chances of achieving financial security, avoid these 4 mistakes: 1. Waiting too…

The power of saving early and steadily for the long term can make a great impact on your retirement lifestyle. In this installment of Life & Money Matters Peter shares some thoughts on the benefits of paying yourself first. Transcript: Pay Yourself First Life & Money Matters

Market volatility and increasing expenses can have many retirees concerned whether their retirement income will last as long as they live. In this video segment, Peter discusses four key retirement questions you should consider to help plan for the unexpected. Transcript: Four Retirement Questions for Retirees Life & Money Matters: Four Retirement Questions for Retirees…

Media headlines and market uncertainty have left many aging investors with the feeling “I’m worried that I won’t have enough”. In this first segment of Life & Money Matters, Peter shares some of the top retirement planning concerns among investors. Transcript: Top Retirement Planning Concerns Life & Money Matters

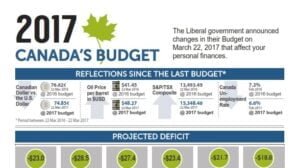

The new Liberal government announced changes in their budget in March, 2017 that affect your personal finances. PDF Version