Understanding the different types of life insurance

There are different types of life insurance to suit the needs of different people. Understanding the difference can really help you to choose a solution that works best for you. Talking with an advisor is obligation-free and may put you more at ease with making decisions that will have a financial impact as well as an impact on your peace of mind.

What Kind of Life Insurance do I Need?

If you’re confused or overwhelmed by all of the names, choices, bells and whistles associated with different kinds of life insurance policies, you’re not alone. And part of that is not your fault. The industry is full of different names for the same thing and uses more than its share of acronyms and jargon.

You owe it to yourself and the people and issues you care about to educate yourself on the life insurance basics. Then seek out a licensed and preferably accredited financial advisor to help you out with a financial needs analysis. Interview a few of them and select someone you are comfortable with. Pick someone you can trust and who demonstrates that they will take the time and effort to improve your financial literacy, look after your best interests and who can grow with you. That person can then recommend options, provide some of the details, where to buy it and what kind to buy. They will then continue an ongoing, active relationship with you.

There are some life insurance basics that should be pretty easy to understand. Let me help you with that.

There are two kinds of life insurance, term and permanent. Over time, these two kinds of life insurance are designed to cover off two kinds of needs and wants, temporary and permanent.

What is Term Insurance?

Term insurance covers you for a period of time. You rent it. You may be able to renew it, at higher and higher rates. Eventually the coverage ends and for most people it ends before you do, typically around age 75. Average life expectancy is now in the 80s.

How does term insurance work? Rates may be guaranteed to stay the same for periods of time. Think about terms like 10 year term, 20 year term or term 30. That describes how long the coverage and those rates will last. If the coverage is guaranteed renewable term, then you have the option of continuing the coverage at whatever the rates are then. Many life insurance policies will guarantee what those rates will be at the beginning and include the rates in the contract. That takes the worry out of wondering if you can still have the coverage and what it will cost you as you get older and develop health conditions or a family history that may otherwise increase your rates, perhaps dramatically so.

Although term insurance generally provides temporary coverage for a specified period of time, it can be used to provide temporary, comparatively inexpensive coverage for a permanent need. Budgets may be tight and when that’s the case, having the right amount of life insurance may be more important than having the right kind, at least for a period of time.

Term insurance can be purchased on its own or added to a permanent life insurance policy as a rider. Down the road, if you don’t need the term insurance anymore, you can drop it. If you need more permanent coverage and don’t want to worry about qualifying for it by having good health and habits, you can convert some or all of that term life insurance to permanent life insurance.

What is Permanent or Whole Life Insurance?

Permanent insurance can cover you for as long as you live provide you pay the required premium. That’s why you hear and read the name, whole life. You may also have heard the name Term 100. As you may easily figure out, that describes a policy that provides coverage until age 100. Oh, by the way, premium is another way of saying the price you pay for the amount of coverage you have on your life.

Permanent life insurance generally becomes paid up at age 100. That means you don’t have to pay for it anymore. The insurance company then pays out the death benefit or sum insured when you pass away. You generally pay premiums for your whole life too. Options exist to pay if off faster, like a mortgage on your home and the limited payment period may be guaranteed. That means once you pay the required amount and number of premiums, you’re done. The life insurance you bought is guaranteed to be paid-up in full. The coverage lasts for as long as you live.

How does Permanent Life Insurance work?

The cost of permanent life insurance is generally the same for your entire life. It may or may not have a cash value component. Importantly, with a permanent life insurance policy, you own it. Most permanent life insurance has an equity component, called a cash value. That cash value generally has guaranteed values as well as total cash values. The cash value can grow over time and depends on how much you deposit over and above what’s needed to pay for the pure risk of dying that the Life insurance company takes on. You, along with millions of other Canadians that purchase life insurance, share those risks collectively. That keeps the cost down when compared to doing it yourself with cash, liquidating assets or borrowing money that someone has to pay back with interest.

Does Life Insurance just Provide Death Benefits?

The recently published Canadian Life & Health Insurance Facts, 2020 Edition, shared that the industry paid out $12.1 Billion dollars in life insurance benefits last year. Of that total, $4.4 Billion was paid to living policyholders as disability benefits, cash surrenders or dividends.

Cash Value Life Insurance

Let’s go back to permanent life insurance and those cash values or growing equity in those contracts. Remember, you are essentially renting term insurance, so like renting a home or apartment, you aren’t building any equity into it for yourself.

You can access that cash value in various ways. You can borrow directly from the insurer or withdraw cash, no questions asked and with no contractual condition to pay it back. Either option will reduce the amount of coverage paid when you pass away. Alternatively, you can use the cash value of the policy, perhaps even the sum insured or death benefit, as collateral for a bank loan.

Is life insurance an investment? It can be. Many individuals and business owners see it as an important asset class. It offers them the ability to deposit money and grow it on a tax-sheltered basis. That tax-sheltered growth may be passed on to spouses/partners or children intact and without triggering any income tax. It depends of course on how the policy is structured at the outset. The cash value is also paid out as part of the total sum insured or death benefit when the life insured passes away. It’s almost always tax-free.

You can downsize your permanent life insurance policy, perhaps to the point of having permanent coverage for a lower amount and no more payments. Think of it like owning a home with a mortgage and where you have built up some equity. You may decide far down the road to downsize your home and buy another one with the equity you built up. You move into your new, smaller home mortgage free.

You may do the same thing with permanent life insurance. The difference is that you don’t move policies. You keep the same one for a reduced amount of coverage and it’s completely paid for. That reduced amount of life insurance still has a cash value. That cash value will still grow, although more slowly than before and be paid out as part of the sum insured, and again, almost always tax-free when you pass away.

Finally, if you don’t need the coverage anymore, you can cash it in and take the cash surrender value. There may be taxes to pay on that amount. More on that in another article on Life Insurance and Taxes.

What Can I Use the Cash Value for?

The cash values may be used for financial emergencies, a down payment on a home, a car or to help pay for education. They may be used to supplement retirement cash and income needs. They can form part of a tax sheltered legacy for children and grandchildren, particularly if the life insured is a child. What life event may create a need for easy to access cash, without a credit check or questions to answer? Cash values in a life insurance policy could provide an alternative source of emergency funds.

What’s the Best Kind of Life Insurance to Buy?

A common question is “Which is better, term life insurance or whole life insurance?” To answer that question you will need to answer this one: “What do you need it for?” The best kind of insurance is the kind that is paid when you pass away. And it’s for the amount that is needed to provide for those left behind. The recipient of a claims cheque doesn’t ask what kind of insurance the deceased had. They simply ask; How much was it? Will it be enough? Will the survivors be okay?

The ideal solution needs to do two things. It needs to fit your need and it needs to fit your pocketbook. It makes little sense to buy permanent or whole life insurance and not have enough left over to pay for other necessities in life. It makes no sense to buy permanent life insurance that only covers some of your total need because you can’t afford to buy all of the coverage you need. It may also not make sense to buy permanent coverage for a temporary need.

On the other hand, why buy term life insurance to cover a permanent need? Eventually the coverage ends and the need is still there. Meanwhile, the cost of that coverage keeps going up the older you get. What are your options when the term coverage runs out and the need is still there? Does your estate pay for that by self insuring using cash, investments or other assets that need to be sold? Take a look at the article on Life Insurance, how much is enough? for a comparison of the cost of various options.

You may be able to convert your term insurance to permanent insurance without providing evidence of insurability. In other words, look for a term insurance policy where you may be able to convert to permanent life insurance regardless of your health or the risks you take in life. Buying permanent life insurance late in life may really stress your budget because all life insurance is based in part on how old you are when you buy it.

Some needs will go away. Some needs will change. For most people, the ideal solution is probably a mix of term insurance and permanent life insurance coverage. You may have a permanent need that you presently can’t afford to cover with permanent insurance. So get the total amount of coverage you need now in term insurance. Plan on converting all or a portion of the term insurance to permanent coverage as your financial situation improves.

Term insurance provides temporary coverage on a cost effective basis for younger people. Permanent insurance like whole life, universal life or Term 100 offers cost effective coverage for as long as you live. The cost is generally level. You pay more in the early years than for comparable term insurance and less, perhaps far less than term insurance in the later years, when term insurance may not be available at any price.

Be careful about cancelling a life insurance policy because the original need went away. Other needs may have arisen and the needs that are still there may now need more money. Your health or habits may have changed too and not for the better. That may make it harder to get life insurance at reasonable rates.

As you can probably figure out, most people would benefit from a combination of term insurance and permanent life insurance.

Term Life Insurance: the Basics

Term life insurance is temporary coverage. It provides that coverage for a set number of years or until a certain age. It may be renewable for the same period or until a set age, at a higher rate which is usually guaranteed in the contract. The coverage amount stays the same if that’s what you want. You can lower the amount of life insurance down the road to keep the premiums in line with your budget. The rates down the road generally don’t depend on you maintaining your health or healthy habits; just your age.

Decreasing term insurance provides coverage for a set period of time. The difference here is that the premium stays the same but the coverage drops, eventually to zero.

It should go without saying that you must die while the policy is in force and your payments have been made in order for the sum insured to be paid out. Term insurance policies other than perhaps Term 100 have no cash values. And most of these policies will have an end date that is well before the average person passes away. Most term insurance is both renewable and convertible.

Convertibility

Many term insurance policies offer a feature that allows you to convert your term coverage into permanent coverage. You may have heard the phrase, convertible term. This may be an attractive feature for people who need permanent protection but are on a tight budget at the present time. People can buy the amount of coverage they need now at affordable rates within their spending limits now and convert some or all of that temporary protection to permanent protection once their financial situation improves. The ability to convert to permanent life insurance is not based on your health at the time you exercise the conversion option.

Permanent Life Insurance: the Basics

Permanent life insurance comes in various forms: whole life, universal life and variable or adjustable life insurance. It generally provides guaranteed, lifetime coverage as long as you pay the required premiums.

Level Premiums

Most permanent policies may be structured to have premiums that remain the same for as long as the policy is in force. It doesn’t matter if you get older, pick up some unhealthy habits or develop diseases. The extra amount you pay for the risk being covered in the early years creates a reserve that is invested and used to pay for the extra risk you aren’t paying for in the later years. The insurance company determines the reserve by considering such factors as mortality, interest or investment returns and expenses. Bottom line, you pay the same amount each month, each year. The insurance company takes on the risk of paying out any death benefits and handling the reserve to make sure it is adequate to support level premiums.

Cash Values

The reserves set aside to pay for the higher risks later in life may provide a growing cash value as well, depending on the contract. The cash value is normally paid out as part of the sum insured, not in addition to it, though there may be exceptions with some universal life policies. Basic cash values may be guaranteed by the contract. Total cash values will vary depending on whether dividends are shared, how they are used and the performance of the fund.

Whole life policies and dividends: Policies may participate in the positive experience of insurance companies.

Participating Whole Life Insurance

This type of policy participates in the financial experience of the insurance company through dividends. The premiums charged to you are based on more conservative assumptions of death claims (mortality), interest and investment earnings, and future expenses of administering this block of business. When actual experience is better than the assumptions, the vast majority is contractually shared with participating policyholders as a dividend.

Dividends

Dividends paid to you represent your share of the surplus earnings of the life insurance company. They are usually used to buy additional permanent insurance that is fully paid for at no cost to you. That extra paid up insurance also has increasing cash values. Dividends may also be used to buy one-year term insurance which in turn may be replaced by paid up insurance. Dividends may be paid out in cash or even be used to pay for part or all of the premiums, depending on the size of the dividend and the premium due. Dividends may be allowed to accumulate in the policy and earn interest or be invested in funds. On the death of the life insured, these accumulated dividends would be paid out in addition to the basic sum insured. Keep in mind that any earnings on dividends used this way may be subject to income tax.

Non-Participating Whole Life Insurance (Non-Par) or Term 100 Life Insurance

Non-Par policies generally do not share in the surplus earnings and experience of the life insurance company. Term 100 life insurance may not even have a cash value.

Some Non-Par life insurance policies may share in the experience of the insurance company. Some policies may pay a performance credit. A performance credit allows policy holders to share in the investment experience on those policies issued by the insurance company

Universal Life

This is often referred to as an unbundled life insurance policy. It has an insurance portion and an investment portion. You can decide on what type of insurance structure you want to have and then choose what type of investment best suits your needs and risk tolerance. Within limits, the investment grows on a tax-sheltered basis in an exempt account, that is to say, exempt from annual taxation on its earnings. The exempt account forms either part of the total sum insured or may be paid out in addition to the basic sum insured on your death. In almost all cases the total death benefit will be paid out tax-free.

Variable or Adjustable Life Insurance

This is another type of non-participating life insurance. No dividends or performance credits are available. What you pay, the amount of coverage and/or cash values are periodically re-determined by the insurance company. The insurance company may make changes in response to changes in investment returns, expenses and claims experience. The changes may increase or decrease the amount of coverage,premiums and cash values.

The sum insured may have a guaranteed base amount of coverage with the rest of it varying with the performance of the fund which forms part of the policy. The cash values may vary depending on the performance of the fund or some related index. The premiums for variable life insurance may or may not be guaranteed.

Joint Life Insurance

Life insurance plans may offer coverage based on the lives of two or more people under one contract. The coverage is best suited when there is a common needor shared liability which will need to be addressed when one of the insured livespasses away.

Under joint first to die coverage, the death benefit is paid out when either one of the insured people die. This type of life insurance is generally more expensive than single coverage on either life, but cheaper than the same amount of coverage on both lives.

Under joint last to die coverage, the death benefit is paid when the last insured person passes away. This type of life insurance may be less expensive than single coverage on both lives and perhaps cheaper than life insurance on either life insured.

Multi-Life Coverage

This type of coverage insures more than one life under one contract. The amount of life insurance can be the same or different for each life insured. This type of life insurance pays a death benefit for each life insured. It is cheaper than separate policies on each person.

Advanced Death Benefits

Most life insurance companies offer terminally ill policyholders access to part of the death benefit payable under their life insurance policies. Typically, an advance payment is made to policyholders who have a life expectancy of less than 24 months. The payment is made by way of an extra contractual, collateral loan against the life insurance policy. It is considered a tax-free payment under current legislation. When the life insured passes away, the insurance company subtracts the loaned amount plus interest, if any, from the proceeds. The balance is paid out to the beneficiary of the policy.

What Factors Affect the Cost of Life Insurance?

What Factors Affect the Cost of Life Insurance?Your age, health, family health history, pursuits like skydiving, scuba diving, racing cars and social habits like drinking, smoking and recreational drug use all affect the cost of life insurance. You can buy simplified issue life insurance or guaranteed issue life insurance which either ask few or no health history or lifestyle questions, albeit at a higher price.

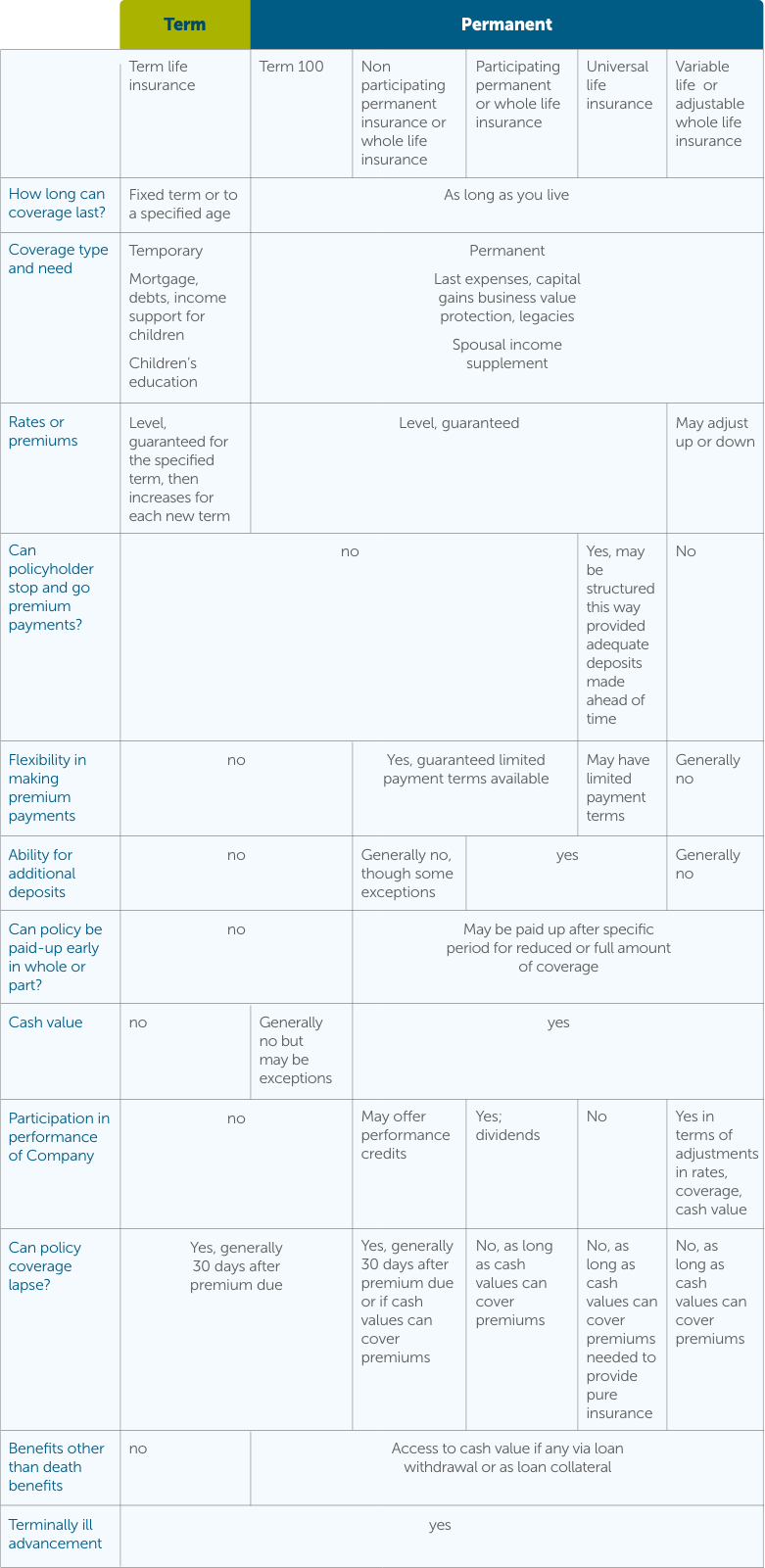

Let’s look at this handy chart for a comparison of these types of policies. It may help you decide what best works for you.

Life insurance is an insurance policy that will pay out a financial sum of money to your family when you die. And most of the time, it’s all tax-free. If you have dependents relying on you for an income, it helps to have life insurance in place.You can choose to have them receive:

- a lump sum

- an income for a certain period of time or for life or

- a combination of the two. You can even customize it for different beneficiaries, the people to whom you want the money to go.

They can use the money to pay off debts, fund education, pay last expenses or provide an income. This will give you and them peace of mind. It can ease financial and emotional stress. Life insurance can answer your family’s question; Will I be okay? Financial advisors who have delivered claim cheques have very rarely been asked the question; what kind of insurance did the deceased have? They are often asked; will it be enough?