Understanding the relationship between life insurance and taxes can save your money

Many of us don’t realize or fully appreciate that our own death or that of a loved one can trigger a large and unintended tax burden. Fortunately, life insurance can minimize this risk.

There are many reasons why people buy life insurance.

Life insurance helps people and businesses manage their risk. It provides security for their families and businesses. Life insurance can be a valuable and integral tool used in personal and business financial planning, estate planning, retirement planning and tax planning. It is often used to pay for taxes triggered by the death of the life insured. Let’s invest some time learning more about life insurance and taxation.

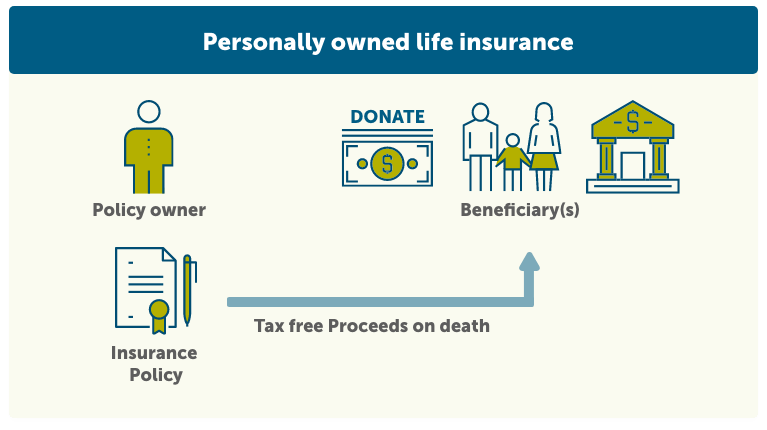

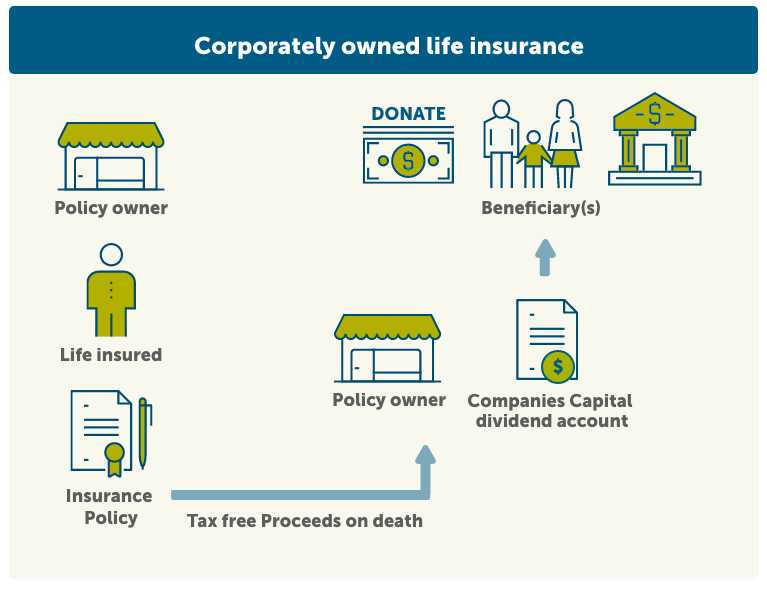

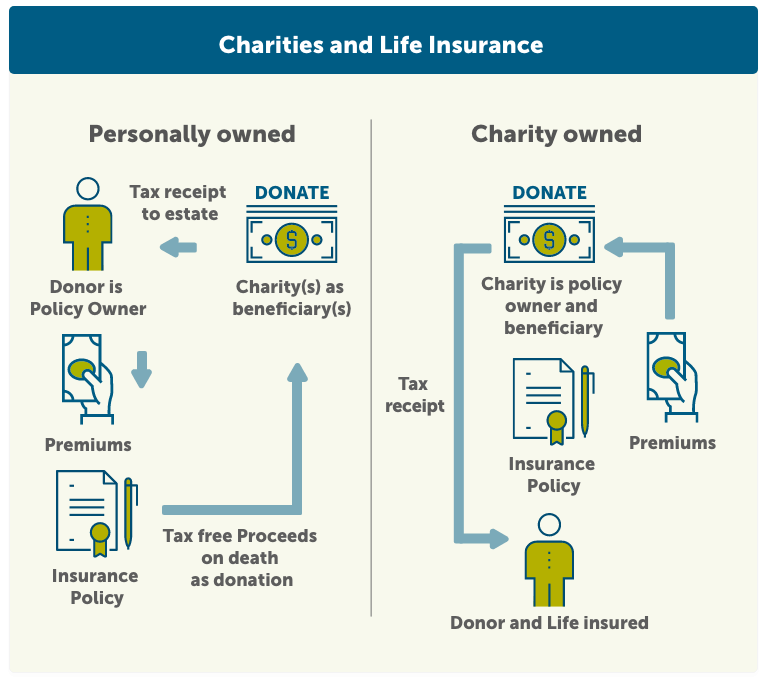

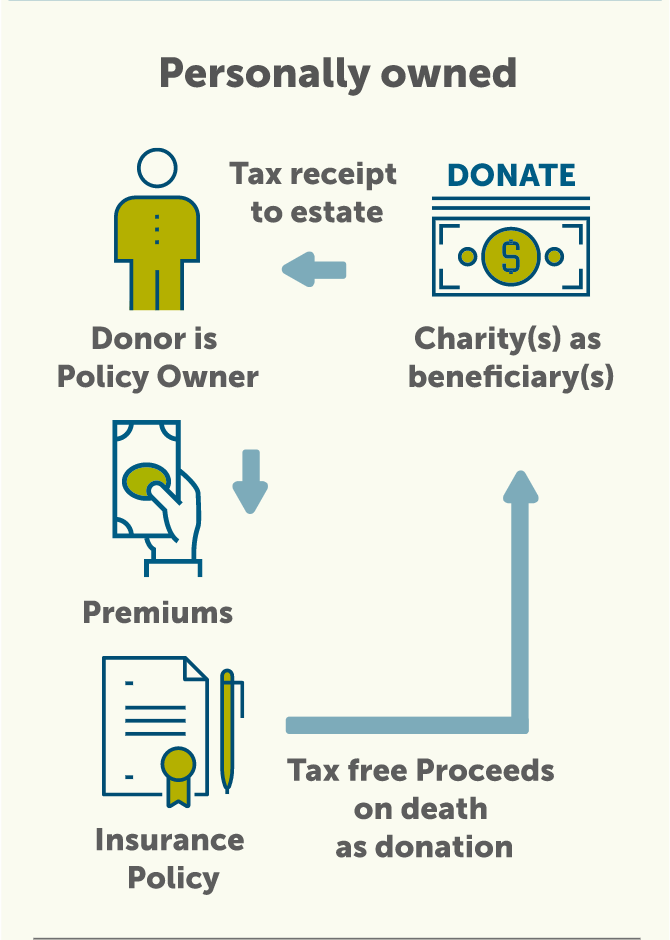

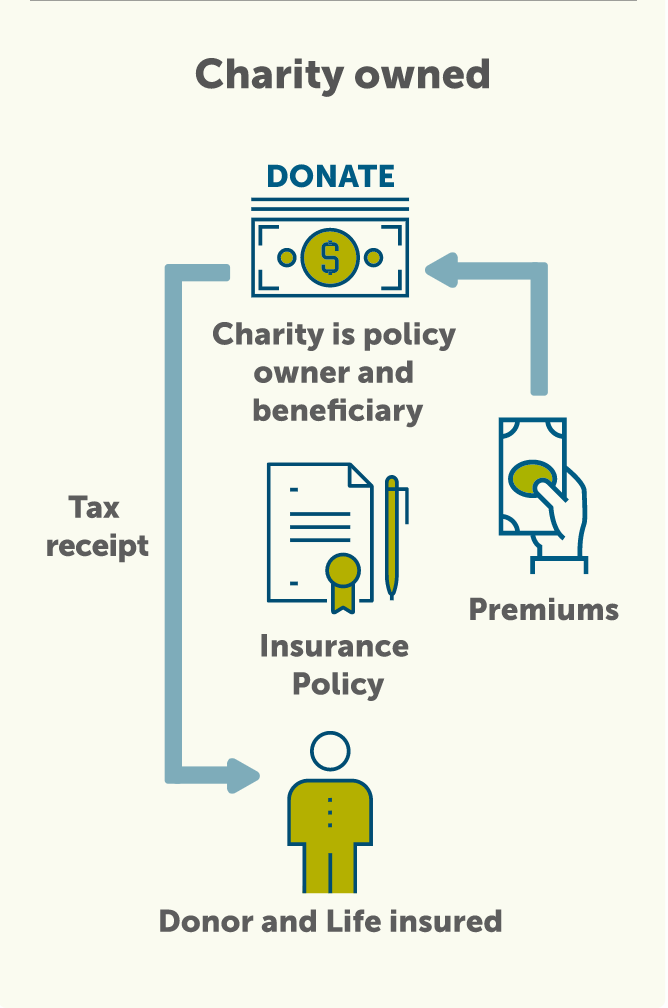

Life insurance may be owned by an individual, a corporation, a charity or even a trust under certain circumstances. Policy owners may name a beneficiary(s) other than their own estate who would receive the benefits on the death of the life insured. The choice is theirs in most cases and is one that can be changed as long as the policy owner has the mental capacity to do so. In almost all cases, the benefits would be paid out to the beneficiary(s) tax free.

The most common concern with estate taxes and life insurance comes from people with a US connection. It applies to US citizens, dual citizens of the USA and another country regardless of where they live, Green Card holders and deemed USA residents. U.S. estate taxes may also apply to alien non residents (think Canadian snowbirds) who die owning U.S. property. These people have valid concerns if they have any “incidence of ownership” in the policy. They own the policy and/or can control the naming of beneficiaries and payouts.

The full death benefit of a life insurance policy is included in the value of a deceased person’s worldwide estate in the USA. That helps set the rate of federal and state estate taxes. No estate taxes are owed on life insurance. Life insurance proceeds on death are still tax free.

There are no estate taxes per se in Canada (TBC). Assets dealt with through a will may have to go through probate, which generates filing costs, probate fees or estate administration taxes in Canada and the U.S. Not all assets need to go through probate. The estate of someone dying without a will may have to go through probate court. There are ways of avoiding probate. When the owner names a beneficiary(s), life insurance proceeds may pass outside the estate and go directly to beneficiaries.

Here are the main ways insurance policies are set up. All provide for tax free payouts on the death of the life insured.

The cost of life insurance, often referred to as premiums, are generally not deductible, regardless of ownership structure. This is one of the biggest reasons why the benefits on the death of the life insured are tax-free when paid out to the beneficiary. An equally important feature and benefit of cash value life insurance is that most of these types of life insurance are exempt policies. That means that the money growing inside the life insurance policy as accumulated values or cash values can do so on a tax deferred basis within limits set up under the Income Tax Act (Canada).

Tax Sheltered Growth in a Life Insurance Policy

The growth in the life insurance policy accumulates on a tax sheltered basis for amounts up to a benchmark “exemption test policy.” Don’t worry too much about this since the insurance company must track these values. The insurance company monitors the life insurance policy to make sure that it maintains its tax exempt status. These funds are not subject to accrual taxation. Policy owners benefit from having all of the extra deposits and interest on those deposits work for them within prescribed limits set by the Income Tax Act (Canada). The tax free payout of proceeds on the death of the life insured includes both the pure death benefit and the amount growing inside the policy.

There are scenarios where certain policy loans, cash withdrawals and transfers of an interest in the life insurance policy may be taxable when any of these triggering events occurs. Any portion of the cash value that becomes taxable is fully taxable as ordinary income. The life insurance policy does not have to be a permanent life insurance policy to fall under potential tax rules. The rules on the transfer of an interest in a life insurance policy apply to term insurance as well.

Here’s a glossary of terms that can guide you in your understanding of life insurance pricing and taxation.

net cost of pure insurance (NCPI): Net amount of risk x Mortality factor

When you think about it, the net cost of pure insurance increases as people get older because the chance of dying also increases as people get older. There are regulations in the Income Tax Act (Canada) which govern how the net cost of pure insurance is calculated. The regulations are different depending on when the life insurance policy was issued.

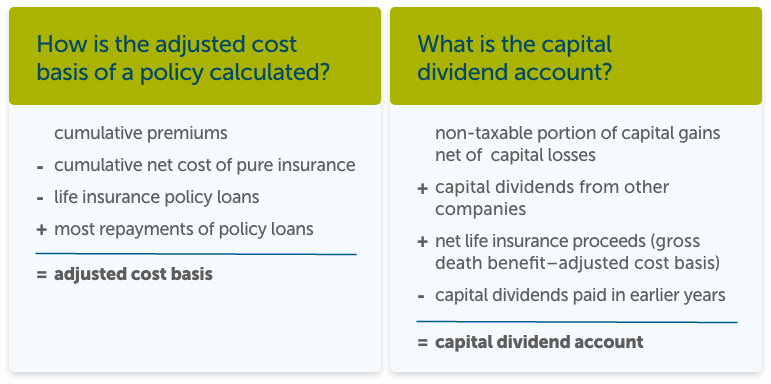

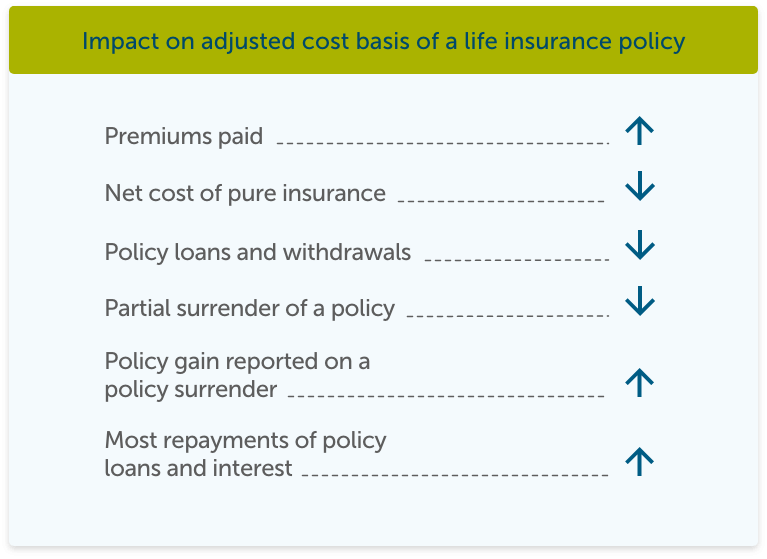

Adjusted Cost Basis (ACB): The insurance company is responsible for calculating the adjusted cost basis of a life insurance policy. It’s a complex calculation. All policies issued after 2016 have an adjusted cost basis, most important for corporately owned life insurance policies. How is it calculated? See a simplified formula for the calculation of this factor in the above chart.

All of this is important because the adjusted cost basis is used to determine if there has been a gain that must be reported for income tax purposes when:

- money is borrowed or withdrawn from the policy,

- the policy is surrendered in whole or in part,

- ownership of an interest in the policy is transferred or

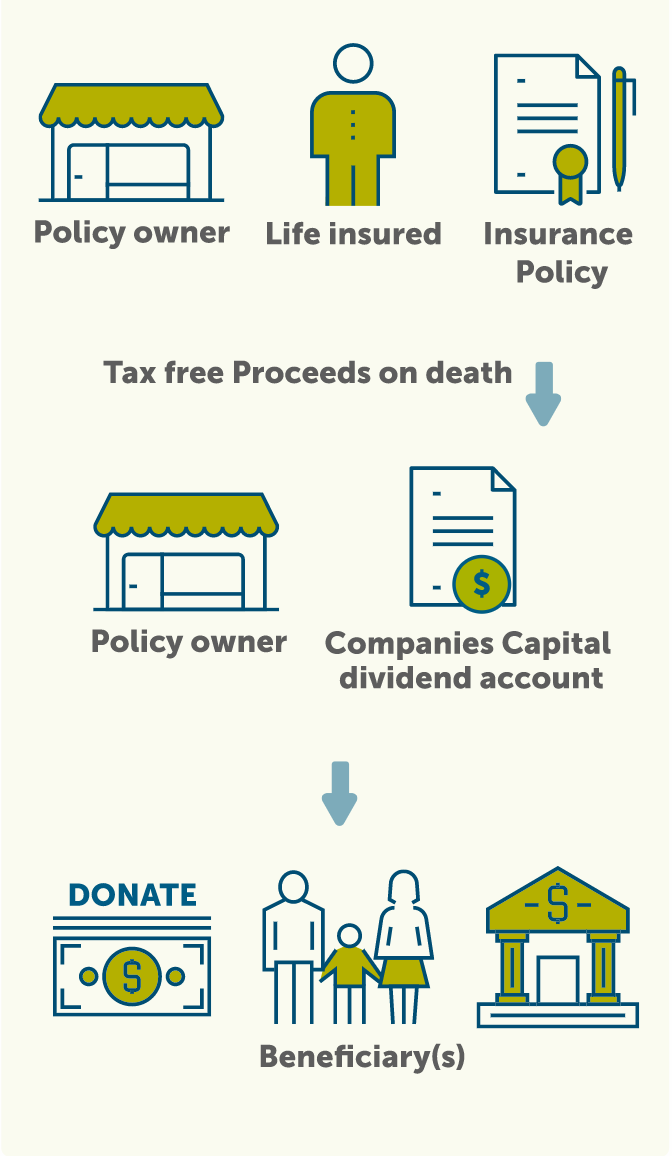

- a private corporation owns the policy and it needs to calculate how much of the death benefit may be credited to its capital dividend account. A positive balance in this account allows directors of the company to declare and pay out a capital dividend which is tax free to select shareholders.

Let’s look at each one of these events from a taxation perspective.

Policy Loans and Taxation

A policy loan occurs when the policy owner wishes to access part of the cash value of a permanent life insurance policy that has a cash value component. The life insurance company advances money under the terms and conditions of the life insurance policy contract. In essence, a policy owner is borrowing against the value of the policy. A policy owner may borrow up to the adjusted cost basis of the policy without triggering an income gain upon which income tax may be owed. If the policy loan is greater than the adjusted cost basis, then the insurance company issues a tax slip showing the policy gain. It is treated as ordinary income. The loan need not be repaid, though interest will be charged which is either paid by the policy owner or added to the loan amount. If there is an outstanding loan at the time of death, the loan amount is deducted from the proceeds and the balance paid out to the estate or named beneficiaries.

Most insurance companies will loan a policy owner up to 90%, and some will loan up to 100%, against the cash value of the policy. Meanwhile, the cash value still earns dividends if it is a permanent participating life insurance policy.

A withdrawal of cash value operates a little differently. This generally results in a partial surrender of the policy, lowering the death benefit of the policy. Let’s assume that the insurance policy has no outstanding policy loans. There are two main ways that a gain for income tax purposes is calculated. It depends on when the life insurance policy was issued. The adjusted cost basis is impacted slightly differently in each case. Also, the net cost of pure insurance is calculated differently for policies depending on when they were issued.

-

Insurance policies issued after Dec. 1, 1982 and before Jan. 1, 2017The adjusted cost basis of the partially surrendered amount is the proportion of the adjusted cost basis of the policy owner’s entire interest in the life insurance policy that the surrendered amount is of the accumulating fund of the insurance policy immediately before the withdrawal. The accumulating fund may be higher than the cash surrender value of the policy. This means that less of the adjusted cost basis is available to reduce the amount of the withdrawal subject to income tax.

-

Insurance policies issued after Dec. 31, 2016The insurance policy’s adjusted cost basis is allocated on a proportionate basis in the same ratio that the withdrawn amount is of the total cash value, again, less any policy loans. For example, if ½ of the cash value is withdrawn, then ½ of the insurance policy’s adjusted cost basis may be used to reduce the amount of the withdrawal subject to income tax. The adjusted cost basis takes longer to go to zero so this may benefit individuals accessing cash directly from their insurance policies.

It’s good to know that the calculations are done differently. It’s also good to know that the insurance company does them for you.

Collateral Loans at a “Bank”

One other way of accessing the cash value of a life insurance policy is by arranging a line of credit at a commercial lending institution like a bank, trust company or credit union and using the life insurance policy as collateral. Absolute ownership of the insurance policy is not being transferred. The rights of the lender are restricted to recouping any outstanding loan amounts from the proceeds of the life insurance policy. This is not considered a transfer for income tax purposes. In addition, there is no deemed disposition that would give rise to income tax. Why? The policy owner is not accessing cash directly from the insurance policy.

The policy owner may default on the loan or the commercial lender may call in some or part of the loan. If the lender uses the cash value of the assigned life insurance policy to pay down the loan, then any gain from the surrender would be taxable to the policy owner. If the borrower dies and the loan has not been paid off, the lender would have first rights to the life insurance proceeds up to the amount outstanding. The balance would be paid out tax-free to the beneficiary(s) under the insurance policy.

Are Life Insurance Premiums Deductible for Income Tax Purposes?

Life insurance premiums are generally not deductible for income tax purposes. There is an exception.

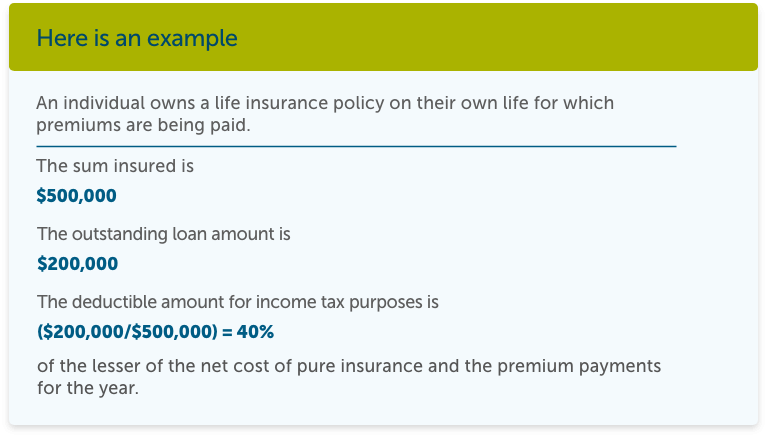

Let’s say a policy owner is borrowing money from a commercial lender like a bank, trust company or credit union in order to earn income from an investment or a business. Interest is paid or payable in the year it is deducted. The interest payable on the loan is generally deductible for income tax purposes. The lender may require life insurance as collateral in the event of the death of the life insured borrower. The policy owner may also deduct the lesser of the premium payments and the net cost of pure insurance for the assigned policy. The amount of the deduction is in proportion to the outstanding loan. The death benefit proceeds are still paid out tax-free.

Transferring an Individual Life Insurance Policy to another Individual

A person may own a life insurance policy on the life of someone else. A transfer of an interest in a life insurance policy is a disposition for income tax purposes. Any gain is included in the transferor’s income. However, there are special rules in the Income Tax Act (Canada) dealing with a transfer from a parent or grandparent to certain individuals. These provisions allow for an automatic rollover on the transfer of an interest in a life insurance policy to a child, spouse or common law partner or former spouse or common law partner if done in a certain way. What that means is that the new owner steps into the shoes of the original owner and the policy continues as before.

The transfer is tax-free. Generally, all the rights and benefits that the original owner had pass on to the new owner. The transferor is deemed to have disposed of their interest in the insurance policy for proceeds of disposition equal to the adjusted cost basis of that interest. There would be no gain to be worried about. The transferee is deemed to have acquired the interest in the life insurance policy for that same adjusted cost basis. Remember, the insurance company provides these calculations. Any future income tax obligations would be the responsibility of the new owner.

Transferring an Interest in a Life Insurance Policy to a Spouse or Common Law Partner

As mentioned earlier, there are special provisions in the Income Tax Act (Canada) that permit an automatic tax free rollover of an interest in a life insurance policy between spouses or common law partners. The life insured doesn’t have to be the policy owner’s spouse or common law partner. Both parties must be considered resident in Canada at the time of transfer during the life of the policy owner or on the death of the policy owner. Let’s consider two scenarios.

-

Tax free transfers during the life of the policy owner: Here again, the adjusted cost basis at the time of transfer of the interest in the life insurance policy will be the same for both parties. Keep in mind the spousal attribution rules. What happens if the policy owner transfers the interest in the life insurance policy and the transferee spouse or common law partner later disposes of the interest in that insurance policy? Any resulting policy gain will be taxed to the original owner as income.

-

Certain policy transfers on the death of the policy owner: A transfer to a former spouse or common law partner resulting from the death of the policy owner’s spouse is considered to be part of a settlement of rights under their marriage or partnership and would not qualify as an automatic tax free rollover.Remember that there is no automatic, tax free rollover to a trust, including a spousal trust.

Transfers out of a Personal Trust

A policy owner cannot transfer an interest in a life insurance policy to a trust on a tax free rollover basis. A tax free rollover is available when a distribution is made to a beneficiary in satisfaction of that person’s capital interest. A transfer of an interest in a life insurance policy owned by the trust as a distribution to a beneficiary of the trust qualifies as a tax free rollover.

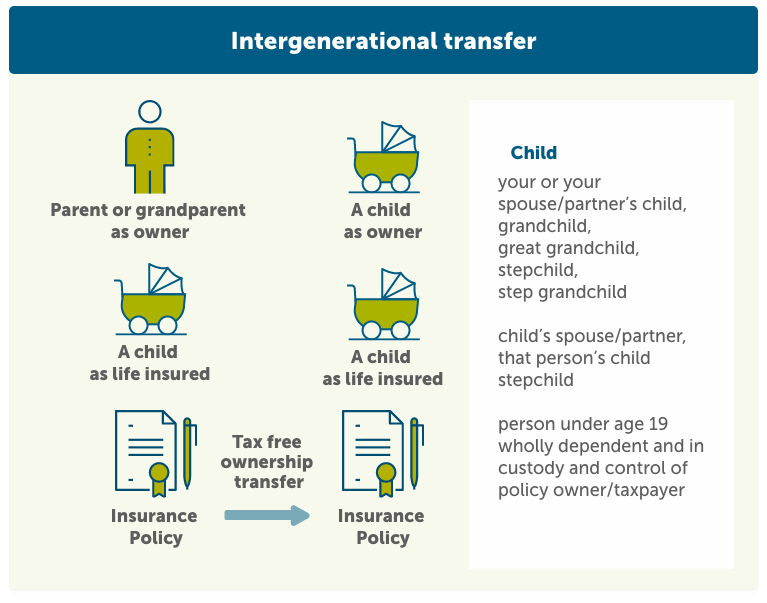

Transferring an Interest in a Life Insurance Policy to a Child Tax Free

As mentioned earlier, parents or grandparents may purchase a life insurance policy on the life of a child or grandchild. The parent or grandparent is the policy owner. The parent or grandparent intends to transfer ownership to a child after that child reaches a certain age or when the parent or grandparent passes away. There is no hard and fast rule as to when or if the transfer of ownership must occur. The parent or grandparent can maintain control of the life insurance policy until they are comfortable that the child is capable of assuming ownership. In the meantime, the parent or grandparent may benefit from tax sheltered growth in a permanent life insurance policy that they can use themselves or leave to grow and pass on to a child later on.

Other than tax free rollovers of registered savings plans and tax free savings accounts between spouses, life insurance is an asset class that can be transferred not just between spouses but down generations. Like those other assets, the policy owner benefits from tax sheltered growth. And like those assets, the tax sheltered growth can be passed on tax free.

The following conditions must exist for an automatic tax free rollover of an interest in a life insurance policy to occur from a parent to a child. There is a broad definition of “child.” (Note: The interest in the life insurance policy must be transferred for no consideration. No money or other asset swaps are exchanged.)

The interest in the life insurance policy must be transferred for no consideration. No money or other asset swaps are exchanged.

-

The life insured under the insurance policy must be a child of the original owner or the transferee. Think of a situation where a grandparent owns a policy on a grandchild and transfers the ownership interest to a parent of the grandchild. The transferee child does not have to be the same person as the child whose life is insured.

-

Only one child may be the life insured under the insurance policy. A tax free rollover would not apply if more than one person is insured, even if all the lives insured meet the definition of child under the Income Tax Act (Canada).

-

The child must be the only person insured under the policy at the time of transfer.

-

The transfer of the interest in the life insurance policy cannot be made under the provisions of the policy owner’s will.

-

The transfer of the interest in the life insurance policy cannot be made to any type of trust. The transfer of the interest in the life insurance policy cannot be made to any type of trust. This is the case even if the trust was set up specifically for the benefit of a child. Consider making the initial transfer to a guardian of the child’s property.

Insurance and Taxation for Business Owners

A policy owner cannot transfer an interest in a life insurance policy to a trust on a tax free rollover basis. A tax free rollover is available when a distribution is made to a beneficiary in satisfaction of that person’s capital interest. A transfer of an interest in a life insurance policy owned by the trust as a distribution to the beneficiary of the trust qualifies as a tax free rollover.

Individuals, Corporations and Life Insurance Transfers

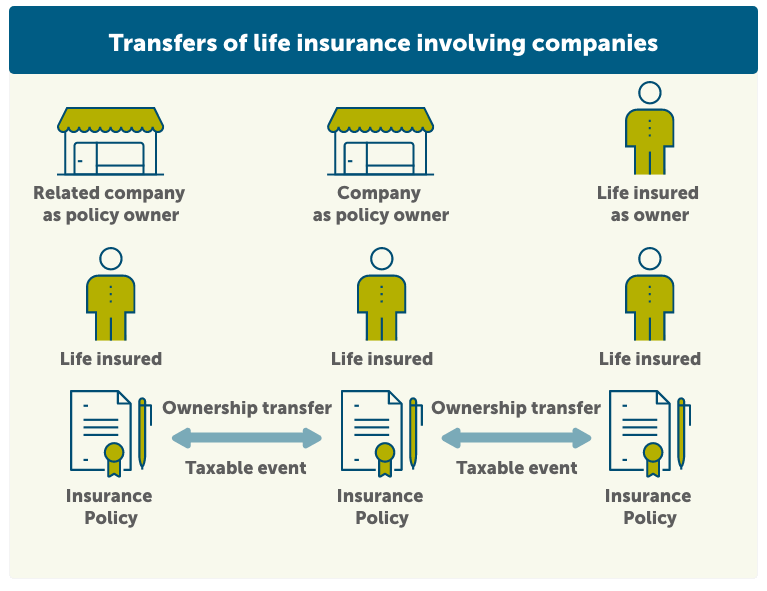

Here is a common question that comes up when a business owner is looking at transferring a life insurance policy either from themselves to their company or from their company to themselves. What are the income tax consequences of a transfer of an interest in a life insurance policy?

A transfer of a policy from an individual to a corporation or vice versa will be deemed a disposition for income tax purposes.

The Income Tax Act (Canada) has rules that will always apply when a transfer is to or from a shareholder or employee who is not deemed to be dealing at arm's length with the corporation. Generally speaking, related persons are not considered to be dealing at arm's length, whether related as family, or shareholders directly or indirectly. That relationship is a question of fact. Each situation may be slightly different.

The deemed proceeds of disposition to the individual and the new adjusted cost basis to the company will be the greatest of the following:

-

the value of the interest in the insurance policy, generally defined in sec 148(9) of the Income Tax Act, as the amount that the policy owner would be entitled to receive if they surrendered the policy, essentially the cash surrender value

-

the fair market value of the consideration, if any, given to the owner for the interest in the insurance policy and

-

the adjusted cost basis (ACB) to the policy owner of the insurance policy immediately before they disposed of it (transfer to or from the company). The buyer and seller will need to find out what the adjusted cost basis of the term policy is.

There will be a gain to the policy owner to the extent that the deemed proceeds of disposition are greater than the insurance policy's adjusted cost basis. Any gain is considered an income gain and will be treated much like interest income for the policy owner disposing or transferring their interest in the insurance policy.

Income Tax Implications for Shareholders and Employees on Policy Transfer

What are the income tax implications for a shareholder or employee when an interest in a corporately owned policy is transferred to them? If the shareholder or employee does not pay fair market value for the interest in the life insurance policy, then there may be a taxable benefit that must be declared by the recipient, specifically when that individual is not considered to be dealing at arm's length with the company. It doesn’t matter whether there is some consideration given for the interest or not if that consideration is less than the fair market value of the policy. Generally speaking, related persons are not considered to be dealing at arm's length, whether related as family, or shareholders directly or indirectly.

The company may be able to deduct this taxable benefit for an employee or a shareholder receiving the benefit in their capacity as an employee. The company cannot deduct the taxable benefit if the transferee is a shareholder. By the way, a shareholder may be another company. A sister company may also be caught by the rules on policy transfers. A policy can generally not be transferred from one corporation to another on a tax free rollover basis. Income tax will be triggered if the proceeds of disposition are greater than the adjusted cost basis of the interest in the life insurance policy being transferred.

Is the Cash Value of a Permanent Life Insurance Policy Considered to be Passive Income?

Here is another common question from business owners. “I own a business. My company owns a life insurance policy. Is the growth in an exempt life insurance policy subject to the passive investment rules that were introduced in 2018”?

First off, the tax sheltering benefits of a permanent life insurance policy exist whether the insurance policy is owned individually or by a corporation.

The passive investment rules reduce the small business deduction if a private corporation or associated companies has adjusted aggregate investment income that exceeds a certain threshold. What does that mean? What type of income would that include?

We are looking at income that is essentially passive investment income. It is not part of the regular income earned by a corporation from its active business operations. Many businesses have money in their companies that is not used in the day to day operations of their companies. The Income Tax Act (Canada) already taxes passive income at the top marginal tax rate, unlike active business income. In addition, the rules set limits on how much income that money can earn before it affects the small business deduction on active business income. The passive investment rules work like this.

The small business deduction reduces the amount of income tax that a Canadian privately controlled company pays on up to $500,000 of active business earnings. The small business deduction is reduced by passive investment income. Specifically, the small business deduction is reduced $5 for every $1 of passive income over $50,000. Once passive income reaches $150,000, the small business deduction is eliminated. ($100,000 x $5 = $500,000).

The good news is that the growth in an exempt life insurance policy is not included in these calculations so long as there is no deemed disposition. What might trigger a taxable gain?

- a policy loan,

- a cash withdrawal,

- a partial or full surrender of an interest in the policy or

- a transfer of an interest in a life insurance policy by the company owning the policy

Does a Corporately Owned Life Insurance Policy Increase the Value of the Company?

The cash value of a life insurance policy owned by a corporation is included when determining the value of the shares of a company. When the shares are sold or transferred, the cash surrender value needs to be factored into the price. What happens if the life insured dies? The cash surrender value immediately before death of the life insured is used to calculate any potential capital gain of the shares. The death benefit does not affect the value of the shares for income tax purposes.

Life insurance products receive unique and specialized tax treatment. That makes the use of life insurance equally unique and special, offering individuals and businesses efficient and effective strategies and solutions aimed at building and preserving their assets, protecting their families and protecting their businesses. There are many tax and non tax considerations when looking at buying a life insurance policy and transferring an interest in an insurance policy. The type of life insurance impacts how working with it may create tax opportunities as well as tax implications.

There is as much information on the taxation of life insurance as there are words in this article. This is a simple overview that tries to cover some of the common questions that people bring up when looking at life insurance and taxation. The information provided is of a general nature. Readers are encouraged to seek independent professional legal, accounting and financial advice before acting or deciding not to act on a particular scenario.