Where do we go from here?

When markets fall, the next peak usually isn’t far away

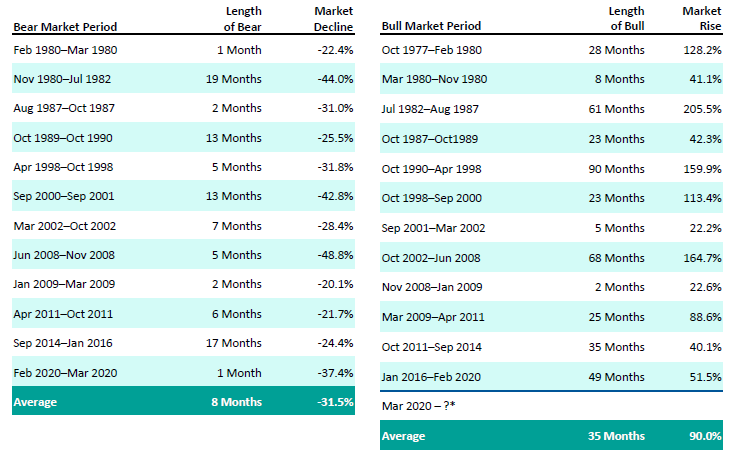

Bear markets can be brutal… But bull markets have a history of charging back.

"The TSX grew 96.71% since the COVID bottom in 2020 to the most recent peak on 3/29/2022. The index then fell 17.02% to the recent bottom on 7/14/2022. The drop has not reached the 20% threshold for a bear market based on the chart's methodology. Therefore, we cannot conclude that the most recent bull market has ended and that we are in a bear market right now for the TSX."

If you’re reading this, there’s a good chance the markets have had a setback. That comes with the territory. But history has shown that falling markets don’t last nearly as long as rising markets – and the valleys typically aren’t nearly as big as the peaks.

Down markets tend to be relatively shallow and short-lived

Stay Focused

Don’t let down markets make you lose sight of your long-term goals.

Stay Invested

Missing the best days of a rising market can drastically reduce your long-term returns.

Stay Diversified

A diverse portfolio can protect you from downturns and give you access to markets and investments that are on the rise.

1. Source: Ned Davis Research Group, Inc. as of July 14, 2022. Bull and Bear Markets are defined as market trends of +20% or more and -20% or more, respectively

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Franklin Templeton prospectus before investing. Mutual funds are

not guaranteed, their values change frequently and past performance may not be repeated.

*As of February 2022, we are still in the bull market that started on 3/23/20. We cannot conclude that the most recent bull market has ended and that we are in a bear market right now for the TSX.

1. Source: Ned Davis Research Group, Inc. as of February 7, 2022. Bull and bear markets are defined as market trends of +20% or more and -20% or more, respectively.

Brought to you by: