The Importance Of Early Retirement Planning – What Every Canadian Should Know

Most Canadians underestimate the critical role that early retirement planning plays in ensuring a comfortable and financially secure future. By taking proactive steps now, you can avoid the dangerous pitfalls of inadequate savings and unforeseen expenses that could derail your retirement dreams. It’s necessary to consider factors such as your lifestyle goals, potential healthcare costs, and the impact of inflation on your savings. For a detailed guide, check out Your Blueprint for a Seamless Retirement in Canada … to set yourself on the right path.

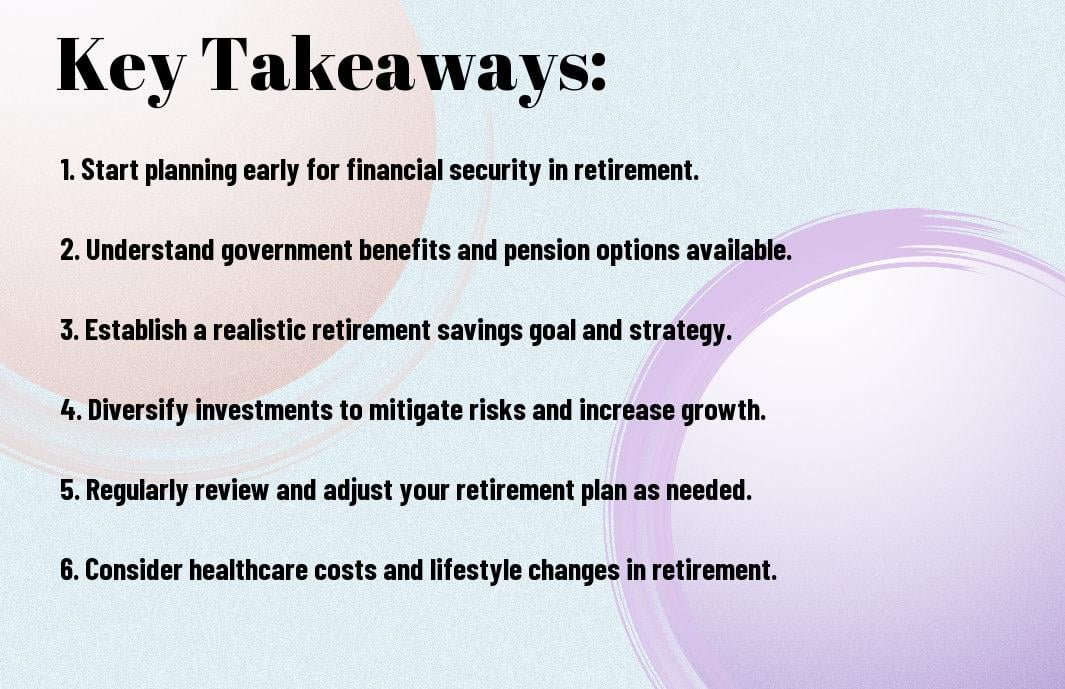

Key Takeaways:

- Financial Security: Early retirement planning ensures that you have the necessary funds to maintain your desired lifestyle without financial stress.

- Compounding Benefits: Starting to save early allows you to take advantage of compound interest, potentially maximizing your savings and investment growth over time.

- Health Considerations: Planning for retirement early can provide peace of mind regarding healthcare costs, allowing you to allocate resources for potential medical needs as you age.

Understanding Retirement Planning

While planning for your retirement may seem daunting, it is crucial for securing your financial future. Retirement planning involves assessing your current financial situation, estimating your future needs, and creating a strategy to ensure you can maintain your desired lifestyle once you stop working. By starting early, you give yourself more time to accumulate savings, navigate investments, and adjust your plans as your circumstances evolve.

Definition of Early Retirement

Understanding early retirement involves recognizing it as the ability to stop working before the traditional retirement age, often defined as 65. This means having sufficient financial resources to support your lifestyle without relying on regular employment income. Early retirement requires a clear plan and commitment to your financial goals.

Benefits of Early Retirement Planning

One of the key benefits of early retirement planning is that it grants you greater financial security and flexibility in your later years. By laying out your goals, you can identify the best savings and investment strategies tailored to your unique situation.

A solid early retirement plan allows you to enjoy your golden years without the burden of financial stress. Starting to plan early enhances your ability to accumulate wealth over time, giving you the freedom to pursue interests, travel, or spend time with loved ones. Moreover, it mitigates the risk of unforeseen expenses or economic downturns; this way, you create a robust financial cushion. Failing to plan might lead to a compromised lifestyle, forcing you to work longer than desired. Embrace the idea of early retirement planning today for a comfortable and secure future.

Assessing Your Financial Needs

Now is the ideal time for you to begin assessing your financial needs for retirement. Understanding how much money you will require to maintain your desired lifestyle is crucial. This involves scrutinizing your current expenses and projecting future needs, considering factors such as healthcare, housing, and leisure activities. By evaluating your financial obligations and goals, you can make informed decisions on how to allocate your resources effectively for a secure retirement.

Estimating Retirement Expenses

To accurately estimate your retirement expenses, you should start by reviewing your current spending habits. Analyze your monthly bills and consider any additional costs you might incur in retirement, like increased healthcare expenses or hobbies you wish to pursue. Creating a detailed budget can help you visualize your future financial landscape and ensure that you’re prepared for the long-term when the time comes.

Identifying Income Sources

With careful planning, it’s important for you to identify potential income sources that can sustain you during retirement. This includes considering your savings, pension plans, social security benefits, and potential investments. Understanding these income streams will help you establish a clearer picture of your financial health and aid in your overall retirement strategy.

Sources of income in retirement can come from several avenues, including personal savings, government pensions, employer-sponsored retirement plans, and investment portfolios. It is necessary to diversify your income sources to create a financial cushion. Additionally, recognizing when to begin drawing from these sources can affect your long-term financial stability. Be proactive by strategizing how to maximize these funds while being mindful of tax implications and withdrawal rules. Ultimately, understanding your income sources is critical to ensuring that your retirement years are free from financial stress.

Investment Strategies for Early Retirement

Many Canadians seeking early retirement should explore diverse investment strategies tailored to their goals. This may include a combination of equities, bonds, and real estate, which can help to maximize your returns while aligning with your risk tolerance. You should also consider tax-advantaged accounts, such as RRSPs and TFSAs, to bolster your savings and grow your wealth efficiently. Through disciplined investing and regularly reviewing your portfolio, you can build a financial foundation that supports your dream of an early retirement.

Saving and Investment Options

Saving for your early retirement starts with understanding the various saving and investment options available to you. Consider contributing to registered accounts like RRSPs and TFSAs, which offer tax benefits and growth potential. Diversification across asset classes, such as stocks, bonds, and mutual funds, can enhance your portfolio’s performance and stability. Additionally, setting up automatic contributions to these accounts can ensure you stay on track to achieve your retirement goals.

Risk Management in Investing

Investment risk management is crucial for safeguarding your retirement savings. You must recognize that all investments carry some level of risk, and it’s important to balance potential rewards with your personal risk tolerance. Diversifying your investments across different asset classes can help mitigate risks, while regularly assessing your portfolio allows you to make adjustments as needed. Furthermore, investing in low-cost index funds or ETFs may offer a stable and less volatile option for long-term growth.

This approach to risk management is vital because it protects your hard-earned money and can significantly impact your retirement plan. By diversifying your investments, you minimize the negative effects of poor-performing assets on your overall portfolio. Staying informed about market conditions and adjusting your investment strategies as you near retirement helps you navigate uncertainties. It’s also wise to consult financial advisors if you are unsure about how to balance risks effectively, ensuring you’re on a path toward a secure early retirement.

Government Programs and Benefits

Not understanding the various government programs and benefits available to you can severely hinder your early retirement planning. In Canada, both the Canada Pension Plan (CPP) and Old Age Security (OAS) are critical components of your retirement income strategy. Familiarizing yourself with these programs is crucial for ensuring your financial security during retirement.

Canada Pension Plan (CPP)

Any Canadian worker contributes to the Canada Pension Plan (CPP), which provides you with a monthly pension once you reach retirement age. The amount you receive depends on your contributions over your working life, making it crucial to plan your retirement contributions wisely.

Old Age Security (OAS)

For Canadians aged 65 and older, the Old Age Security (OAS) program offers a monthly payment that can supplement your retirement income. This benefit is available to most residents, but the amount you receive may be affected by your income level. Be aware that if your income exceeds a certain threshold, you may face a clawback, resulting in reduced OAS payments, which can impact your overall retirement funding.

Pension income from OAS is typically considered a basic, guaranteed payment, but it may not be sufficient to cover all your retirement expenses. It’s crucial to recognize that OAS payments can vary based on factors such as residency duration in Canada and your annual income. Failure to adequately plan for these factors can lead to potential financial strains in retirement, especially if you rely too heavily on OAS as your primary income source. By understanding OAS and aligning your retirement strategy to incorporate this benefit, you can enhance your financial stability during your golden years.

Tax Considerations

All Canadians should recognize the significant impact of tax planning on retirement savings. Tax considerations can affect how much you accumulate for retirement and how much you keep in your pocket when withdrawing funds. Understanding the rules and options available can help you devise a strategy that maximizes your retirement income while minimizing tax liabilities.

Tax Advantages of Registered Accounts

Considerations for registered accounts, such as RRSPs and TFSAs, are crucial for your future retirement. These accounts offer tax-deferred growth or tax-free withdrawal options, allowing your investments to flourish without immediate tax implications. By contributing to these accounts, you can effectively lower your taxable income in the present while enjoying benefits that enhance your financial situation in retirement.

Tax Implications of Early Withdrawal

Any early withdrawal from registered accounts can result in significant tax consequences. It’s important to understand that withdrawing before retirement age can lead to immediate taxation on the withdrawn amount, as well as potential penalties. This means losing a portion of your savings to taxes, which could otherwise have compounded over time.

Plus, if you withdraw funds from your RRSP before you turn 71, you will not only face withholding tax at the time of withdrawal but also include the amount in your income for that tax year, potentially pushing you into a higher tax bracket. It’s crucial to consider both the short-term consequences and the long-term impact on your retirement savings strategy before making any decisions regarding early withdrawals. Your retirement plan should prioritize minimizing these costs to ensure a financially comfortable future.

Common Pitfalls in Retirement Planning

After you have dedicated years to your career, it’s critical to avoid common pitfalls in retirement planning that could jeopardize your financial future. Many Canadians miscalculate their needs and fail to take proactive steps towards creating a robust retirement strategy. Understanding these common mistakes will empower you to make informed decisions that ensure your retirement is secure and comfortable.

Underestimating Costs

Underestimating your future living costs can significantly derail your retirement plans. Many individuals overlook expenses such as housing, utilities, and daily living expenses. Without a realistic budget that accounts for inflation and lifestyle changes, you may find yourself facing financial difficulties in your later years.

Neglecting Health Care Expenses

Underestimating health care costs can be a devastating oversight for your retirement. While you may assume that you will be in good health, medical expenses can escalate as you age. It’s vital to include potential long-term care needs and insurance premiums in your retirement plan.

Expenses associated with health care in retirement can consume a large portion of your budget. With rising medical costs and the unpredictability of health needs, it’s crucial to set aside funds specifically for this purpose. On average, you should expect to spend thousands annually on out-of-pocket health-related expenses, including medications and dental care. By proactively planning for these costs, you will eliminate the risk of having to make difficult choices about your care in the future.

To wrap up

Summing up, understanding the importance of early retirement planning is crucial for you as a Canadian. The sooner you start planning, the more comfortable your retirement years can be. By taking proactive steps today, you can secure your financial future and enjoy peace of mind in your golden years. Don’t overlook the potential of compound interest and investment growth by waiting too long to start saving. For valuable insights, you can read more about Retirement planning: Why it’s important to start early.

FAQ

Q: Why is early retirement planning crucial for Canadians?

A: Early retirement planning is crucial for Canadians because it helps individuals establish financial security and ensures a comfortable lifestyle during retirement years. By starting to save and invest early, Canadians can take advantage of compound interest, which significantly increases the growth of their savings over time. Additionally, early planning allows individuals to set realistic retirement goals, determine adequate savings amounts, and make informed choices about pensions, RRSPs, and other retirement accounts. Not only does this address inflation risks, but it also helps mitigate unexpected expenses that may arise in later life.

Q: What are the key components of a successful retirement plan for Canadians?

A: A successful retirement plan for Canadians should include several key components: 1) Clear retirement goals: Define your desired retirement age, lifestyle, and any specific financial aspirations such as travel or hobbies. 2) Comprehensive budgeting: Create a budget that outlines current expenses and anticipated retirement costs to understand how much savings are necessary. 3) Diverse investment strategy: Allocate savings across a mix of assets like stocks, bonds, and mutual funds to maximize growth potential while minimizing risk. 4) Knowledge of government benefits: Understand available government programs such as Canada Pension Plan (CPP) and Old Age Security (OAS) to estimate future income. 5) Regular reviews: Continuously assess and adjust the retirement plan as life circumstances, goals, or economic conditions change.

Q: How can Canadians overcome the challenges of early retirement planning?

A: Canadians can overcome the challenges of early retirement planning by taking a proactive approach in several ways: 1) Educate Yourself: Stay informed about financial concepts, retirement products, and market trends through workshops, books, and online resources. 2) Seek Professional Advice: Consulting with financial advisors who specialize in retirement planning can provide tailored strategies and help optimize savings plans. 3) Start Small: If the idea of saving large sums feels overwhelming, begin with smaller, manageable contributions and gradually increase them as financial situations improve. 4) Automate Savings: Set up automatic transfers to retirement accounts to ensure consistent contributions and remove the temptation to spend that money elsewhere. 5) Stay Flexible: Be prepared to adjust plans and strategies based on changes in income, health, and market conditions, as flexibility can help address unexpected challenges effectively.