The Essential Guide To Retirement Planning For Canadian Families

Planning for your retirement is crucial to ensure a secure financial future for you and your loved ones. In this guide, you’ll discover key strategies to help you navigate the complexities of retirement planning in Canada, including how to maximize your savings and understand various income sources. Failing to adequately prepare can lead to unforeseen challenges that may jeopardize your family’s comfort. To gain further insights, check out The Ultimate Guide to Retirement Finances for Canadians and ensure you’re on the right track.

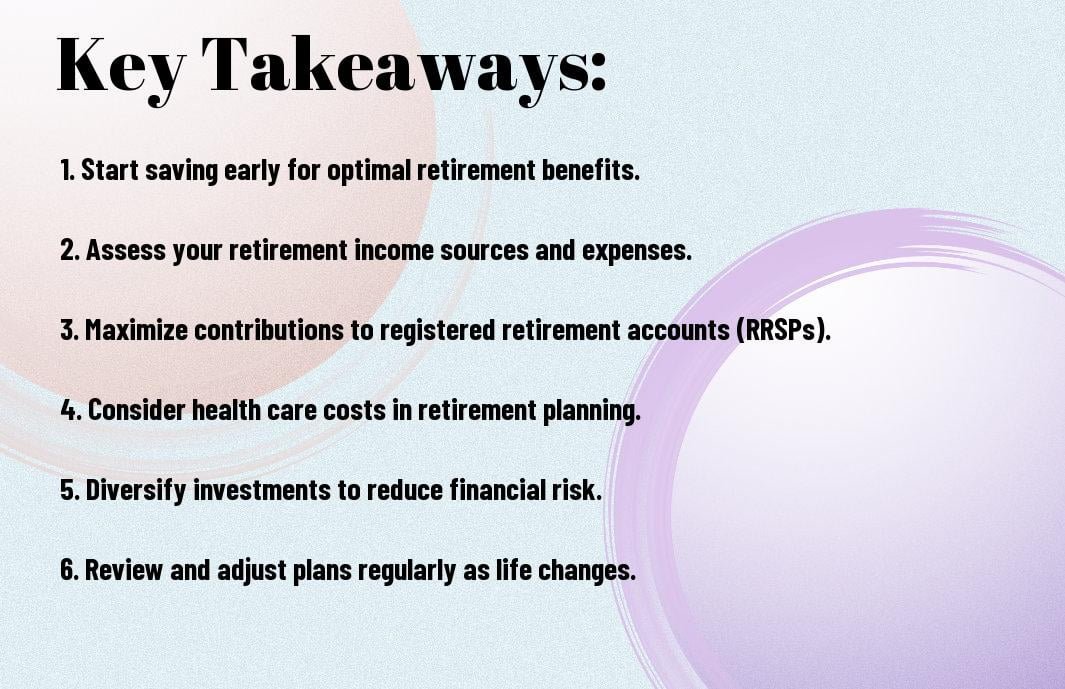

Key Takeaways:

- Early Planning: Start your retirement planning as early as possible to maximize savings and investment growth over time.

- Understand Government Benefits: Familiarize yourself with Canadian government programs like CPP and OAS, as they play a crucial role in retirement income.

- Diverse Investment Strategies: Utilize a mix of investment options, including RRSPs and TFSAs, to enhance your retirement savings and ensure financial security.

Understanding Retirement Planning

The journey to a secure and fulfilling retirement begins with understanding the fundamentals of retirement planning. By developing a comprehensive plan, you are better equipped to navigate the complexities of saving, investing, and managing your money. For valuable insights, consider reading The Complete Idiot’s Guide to a Great Retirement for Canadians, which offers practical advice tailored to your unique needs.

Importance of Retirement Planning

With effective retirement planning, you can ensure that you enjoy your later years without financial worries. A well-structured plan helps you to determine your retirement goals, assess your resources, and make informed decisions regarding saving and investing. By proactively preparing for retirement, you can maintain your desired lifestyle and support your family’s financial security.

Common Misconceptions

Misconceptions about retirement planning can lead you to delay or overlook critical steps in your financial journey. Many people believe that retirement is only for older adults, and they underestimate how much they need to save. Others assume that government benefits alone will suffice, which often leads to inadequate funds for a comfortable retirement.

Planning for your retirement is vital, regardless of your current age or financial situation. The belief that you can rely solely on government pensions is dangerous, as these may not cover all your needs. Furthermore, thinking that retirement planning is too complicated can hinder your progress. In reality, the earlier you start, the more secure your future will be. Educating yourself and taking actionable steps will lead to a positive outcome for you and your family.

Assessing Your Retirement Needs

Little do many families realize that assessing your retirement needs is a crucial step in securing a financially stable future. Understanding how much you’ll require in retirement enables you to set realistic savings goals and tailor your investment strategies accordingly. Consider factors like your desired lifestyle, health care costs, and potential changes in income sources. Taking the time to analyze these elements lays a strong foundation for effective retirement planning.

Calculating Required Income

With the right approach, you can determine how much income you’ll need during retirement to maintain your desired lifestyle. Start by assessing your current monthly expenses and estimate how they may change over time. Consider any additional income sources from pensions, government benefits, or investments that can supplement your required income. This proactive step helps ensure you are adequately prepared for the future.

Identifying Expected Expenses

Required for your effective retirement planning, identifying expected expenses is key to understanding your financial needs in your golden years. Begin by listing all potential costs such as housing, health care, daily living, and unexpected emergencies. Remember that inflation can impact these expenses, potentially leading to higher costs than anticipated. It’s crucial to regularly review and update this estimate to maintain a realistic retirement budget.

A detailed assessment of your expected expenses allows you to adjust your savings and investment strategies effectively. You should factor in both fixed expenses, such as mortgage payments and utility bills, and variable expenses, like travel and entertainment. Additionally, don’t forget to include contingencies for unpredictable costs, such as health care or home repairs, which can significantly impact your retirement funds. By understanding both the regular and irregular expenses you may face, you can better prepare your financial strategy to ensure you enjoy a comfortable retirement.

Government Programs and Benefits

To ensure a secure retirement, it’s necessary for you to understand the various government programs and benefits available in Canada. These programs can significantly supplement your retirement income and alleviate financial concerns during your golden years. By being aware of these options, you can better plan your finances and maximize the support available to you as you transition into retirement.

Canada Pension Plan (CPP)

Benefits from the Canada Pension Plan (CPP) serve as a crucial source of income for Canadians during retirement. You contribute to the plan throughout your working life, and upon reaching the age of 60, you may start receiving monthly payments. The amount you receive is based on your earnings and contributions, which emphasizes the importance of maximizing your contributions early on.

Old Age Security (OAS)

An important government benefit is the Old Age Security (OAS), which provides a monthly pension to seniors aged 65 and older. This program aims to alleviate poverty among older Canadians and is funded by general taxation. While the amount you receive may vary based on your residency in Canada and your income, it plays a significant role in ensuring a baseline income during retirement.

The OAS program is crucial for maintaining your standard of living as you retire. It is not based on your work history, but rather your age and residency status. You should be aware that high-income individuals may have their OAS benefits clawed back. Therefore, planning your financial situation ahead of time can help you determine if you need to supplement your income during retirement. Understanding the intricacies of OAS will empower you to make informed decisions about your retirement planning and better navigate your financial future.

Retirement Savings Options

Now that you understand the importance of planning, it’s time to explore various retirement savings options available to you as a Canadian family. These options can help you build a comfortable nest egg for your golden years, ensuring you have the financial resources needed to maintain your desired lifestyle. Understanding each option’s benefits and limitations is crucial as you make informed decisions about your future financial security.

Registered Retirement Savings Plan (RRSP)

Savings within a Registered Retirement Savings Plan (RRSP) grow tax-deferred until withdrawal, making it a wise choice for long-term retirement planning. You can contribute up to 18% of your earned income from the previous year, up to a specified limit. Contributions are tax-deductible, allowing you to lower your taxable income during your working years, effectively reducing the immediate tax burden.

Tax-Free Savings Account (TFSA)

An important aspect of your retirement planning includes the Tax-Free Savings Account (TFSA), which allows you to save without the burden of taxes on your investment growth or withdrawals. This flexibility can make a significant difference in your strategy, especially for those seeking to balance short-term and long-term savings goals.

Options within a TFSA provide you with the freedom to invest in various financial products like stocks, bonds, and mutual funds. Unlike RRSPs, contributions are made with after-tax dollars, but all earnings and withdrawals are tax-free. This can be particularly advantageous for managing unexpected expenses in retirement or supplementing your income, as it does not affect your Old Age Security (OAS) or Guaranteed Income Supplement (GIS)penalties will apply. Understanding these key points will help you maximize your retirement savings through a TFSA effectively.

Investment Strategies for Retirement

Your journey to a secure retirement hinges on effective investment strategies. By diversifying your portfolio and aligning your investments with your risk tolerance and retirement goals, you can ensure financial stability during your golden years. It’s crucial to remain informed about market trends and adjust your strategy as needed to optimize growth and safeguard your assets.

Asset Allocation

On the path to retirement, establishing a well-thought-out asset allocation is vital. This involves distributing your investments across various asset categories, such as stocks, bonds, and cash, to balance risk and reward. By tailoring your asset mix based on your age, risk tolerance, and time horizon, you can enhance the potential for growth while mitigating risks.

Risk Management

An effective risk management strategy is important for safeguarding your retirement savings. Assessing your investment risks and implementing measures to protect your assets can prevent substantial losses and ensure a stable financial future. This includes diversifying your investments and regularly reviewing your portfolio to respond to market shifts proactively.

Asset allocation and risk management go hand in hand when it comes to fostering a stable investment environment. By employing a diversified portfolio, you can mitigate potential losses and weather market volatility. Additionally, using tools such as stop-loss orders and rebalancing your portfolio regularly can further protect your investments from severe downturns. It’s important to continually reevaluate your risk tolerance and investment goals to adapt your strategy as you approach retirement.

Creating a Comprehensive Retirement Plan

Many families in Canada overlook the importance of a well-structured retirement plan. A comprehensive retirement plan not only provides financial security but also allows you to maintain your desired lifestyle in your golden years. By identifying key components such as savings strategies, investment vehicles, and insurance needs, you can create a solid foundation for your future. Recall, your retirement plan should adapt as your life circumstances change, ensuring that you are prepared for both expected and unexpected events.

Setting Goals

With a clear vision of your retirement, you can set specific, measurable, attainable, relevant, and time-bound (SMART) goals that guide your financial journey. These goals should reflect not just the amount of money you wish to save but also the lifestyle you envision. Whether it’s travel, hobbies, or spending time with family, defining your retirement aspirations will help you stay focused and motivated in your savings and investment efforts.

Regular Review and Adjustment

Creating a retirement plan is just the beginning; it’s crucial to regularly review and adjust your plan to stay aligned with your evolving needs. Life circumstances, economic conditions, and market performance can significantly impact your financial goals and resources.

To ensure your retirement plan remains on track, you should conduct a thorough review at least annually or after any major life changes, such as a job change, marriage, or the birth of a child. During these reviews, assess your progress towards your goals and adjust your contributions and investment strategy as needed. This practice allows you to react to market fluctuations and ensures that your plan is still effective in securing your desired retirement lifestyle. Ignoring this step can lead to underfunding your retirement, leaving you vulnerable in your later years.

Final Words

So, as you launch on your retirement planning journey, remember that careful consideration of your goals, financial resources, and potential challenges will set you up for a secure future. Utilize the tools and resources available to you, including government programs and investment opportunities, to maximize your retirement savings. By taking proactive steps and staying informed about your options, you empower yourself and your family to enjoy a fulfilling and financially stable retirement. Your future begins with the choices you make today.

Q: What are the key components of retirement planning for Canadian families?

A: The key components of retirement planning for Canadian families include setting clear financial goals, understanding various retirement income sources such as CPP (Canada Pension Plan), OAS (Old Age Security), and private savings, and developing a comprehensive budget that considers vital and discretionary expenses. Additionally, families should prioritize debt management, tax efficiency, and consider health care costs in retirement. Engaging with a financial advisor can also provide tailored strategies to optimize their retirement savings and investment plans.

Q: How can Canadian families determine their retirement savings needs?

A: Canadian families can determine their retirement savings needs by estimating their desired retirement lifestyle and calculating the total cost associated with that lifestyle. This includes considering factors such as living expenses, travel plans, and health care needs. It’s beneficial to use retirement calculators that take into account current savings, expected investment returns, and how long the retirement phase will last. Families should also consider inflation and any potential income sources they will have, such as pensions or rental income, to create a realistic savings target.

Q: What tax considerations should Canadian families keep in mind while planning for retirement?

A: When planning for retirement, Canadian families should be aware of various tax considerations that can impact their savings and income. Utilizing tax-advantaged accounts such as RRSPs (Registered Retirement Savings Plans) and TFSA (Tax-Free Savings Accounts) can help in reducing taxable income during working years and allowing for tax-free withdrawals in retirement, respectively. Families should also plan for the tax implications of withdrawing funds from registered accounts, which can increase taxable income. Additionally, understanding how different income sources, like pensions and investment income, will be taxed is crucial for effective retirement planning. Consulting a tax professional can provide insights tailored to each family’s unique situation.