Five Costly Misconceptions About Retirement Savings In Canada

You may be unaware of the costly misconceptions that could jeopardize your retirement savings in Canada. Understanding the truth behind these myths is crucial to achieving your financial security in retirement. Many Canadians hold beliefs that can lead to poor planning and inadequate savings. In this post, we will debunk the top five misconceptions, ensuring that you have the right information to make informed decisions. For a deeper look at related myths, you can check out the five-myths-behind-the-push-to-expand-the-CPP.

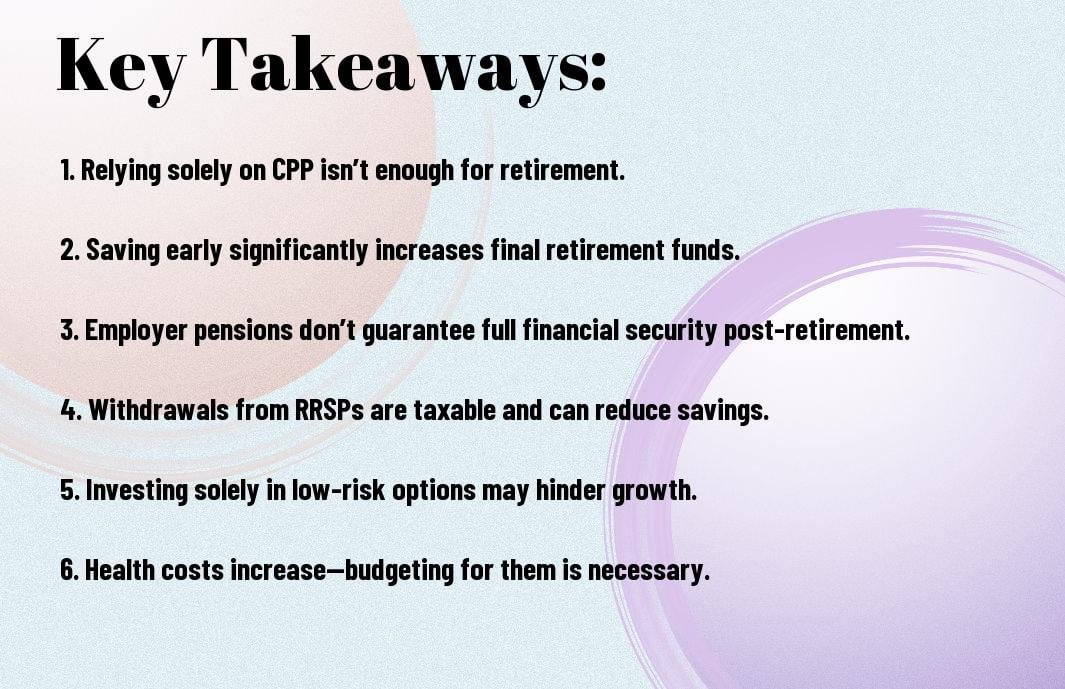

Key Takeaways:

- Relying Solely on CPP Benefits: Many Canadians mistakenly believe that the Canada Pension Plan (CPP) will be sufficient for their retirement needs, underestimating the importance of additional savings and investments.

- Ignoring Tax Implications: A common misconception is that retirement accounts are tax-free. In reality, understanding the tax treatment of withdrawals from different retirement accounts, like RRSPs and TFSAs, is crucial for effective retirement planning.

- Delaying Savings: Some individuals think they can wait to start saving for retirement, believing there is ample time. This misconception disregards the power of compound interest and the benefits of starting early to build a substantial retirement fund.

Understanding Retirement Savings in Canada

The Canadian retirement savings landscape can be complex, making it crucial for you to gain a solid understanding of how it all works. By familiarizing yourself with the available options and strategies, you can better prepare for your financial future. From government-backed plans to personal savings accounts, knowing the ins and outs of retirement savings in Canada will empower you to make informed decisions that align with your retirement goals.

Overview of Canadian Retirement Savings

Any successful retirement strategy starts with understanding the various savings plans available to you as a Canadian. Most Canadians rely on a combination of Government-sponsored programs, workplace pensions, and personal savings to secure their financial future. By grasping these elements, you can strategically allocate your resources to maximize your retirement income and live comfortably in your golden years.

Key Savings Instruments

Retirement savings in Canada primarily revolve around three key instruments: the Registered Retirement Savings Plan (RRSP), the Tax-Free Savings Account (TFSA), and Employer-Sponsored Pensions. Each of these options offers distinct tax advantages and flexibility, providing you with imperative tools to grow your retirement funds.

It’s imperative to understand how each of these instruments works to fully leverage their benefits. The RRSP allows you to defer taxes until withdrawal, making it effective for accumulating savings over time. The TFSA, on the other hand, enables your investments to grow tax-free, with the added advantage of tax-free withdrawals. Meanwhile, employer-sponsored pensions can provide stable income in retirement, often with contributions matched by your employer. By utilizing these tools wisely, you can create a robust retirement savings plan that stands the test of time.

Common Misconceptions

There’s a plethora of misunderstandings about retirement savings that can lead you astray. Many Canadians fall into traps that stem from outdated information or unrealistic expectations. It’s necessary to educate yourself and separate fact from fiction to ensure a secure financial future. Ignoring these misconceptions could hinder your ability to enjoy a comfortable retirement.

Myth 1: “I Don’t Need to Save Until I’m Older”

Save early and often to maximize your retirement savings. Procrastinating on savings can rob you of the benefits of compound interest and leave you drowning in financial uncertainty later. The sooner you start setting aside money for retirement, the more you can accumulate over time. Don’t wait until it feels “right”—begin today!

Myth 2: “CPP is Enough for Retirement”

With many Canadians believing that the Canada Pension Plan (CPP) will provide sufficient income for their retirement, they often overlook the importance of additional savings. This assumption can be damaging, as CPP alone may not cover all your living expenses.

The CPP generally replaces about 25% of your pre-retirement earnings, which is often insufficient for maintaining your desired lifestyle. In addition, the maximum monthly amount you could receive from the CPP is capped, meaning your benefits might fall well short of your financial needs in retirement. Therefore, it’s crucial to develop a comprehensive savings strategy that includes personal savings and potential employer-sponsored plans to ensure a comfortable retirement. Don’t solely rely on CPP—your future self will thank you for planning ahead!

The Impact of Inflation on Savings

All too often, people underestimate the effect of inflation on their retirement savings. As prices rise over time, the purchasing power of your savings diminishes, which means that your nest egg may not stretch as far as you anticipate. This can lead to a stark realization during retirement, where what once seemed like a comfortable amount is suddenly insufficient to cover your living expenses. Understanding this impact is crucial to successful retirement planning.

Understanding Inflation and Its Effects

For many people, inflation is an abstract concept until they experience its effects firsthand. It gradually eats away at your savings’ value, forcing you to spend more money on the same goods and services over time. If your investments do not keep pace with inflation, you risk running out of money during retirement. Thus, it’s vital to include inflation in your financial planning discussions.

Planning for Inflation in Retirement

For effective retirement planning, you need to consider inflation as a significant factor in your financial strategy. Many retirees overlook this aspect and assume their savings will hold their value indefinitely. However, failing to account for inflation may result in a situation where your savings do not provide the income you need for daily living expenses as costs rise.

Impact of inflation can be more severe than you might think; without factoring it into your retirement savings strategy, you risk your ability to maintain your desired lifestyle. It is crucial to design a well-diversified investment portfolio that includes assets likely to outpace inflation, such as stocks or real estate. Additionally, you should regularly review and adjust your savings goals based on current inflation rates to ensure you have enough to meet your needs. Keep in mind, planning for inflation is not just an add-on; it’s an integral part of secure financial futures.

The Importance of Diversification

Not prioritizing diversification in your retirement savings can significantly diminish your financial security. A well-diversified portfolio spreads your investments across various asset classes—such as stocks, bonds, and real estate—thus helping to mitigate risks and optimize returns over time. Relying solely on one type of investment leaves you vulnerable to market fluctuations, which can jeopardize your retirement goals.

Risks of Not Diversifying

Importance of diversification cannot be overstated. When you fail to diversify your investments, you expose yourself to higher levels of risk. A downturn in a specific sector or asset can lead to substantial losses that may not only impact your financial stability but also delay your retirement plans. This kind of concentration risk can severely hinder your ability to generate consistent returns over the long term.

Strategies for a Balanced Portfolio

Portfolio diversification is vital for achieving a balanced investment approach. Start by allocating your assets across different sectors and geographical regions, which helps cushion your portfolio against market volatility. Establish a mix of growth and conservative investments tailored to your risk tolerance, and periodically review and rebalance your portfolio to maintain the desired asset allocation.

Diversification is a strategy that can substantially enhance your investment portfolio’s stability and growth potential. By investing in a variety of asset classes, you are less likely to experience extreme losses if one area underperforms. Shift a portion of your investments into international opportunities, real estate, or even different sectors like technology and healthcare to safeguard your savings. Remember to rebalance your portfolio regularly, as market conditions change, ensuring that your asset allocation stays aligned with your retirement goals. Approaching your retirement savings with a diversified mindset is important for long-term success.

Tax Implications and Benefits

Despite common beliefs, understanding the tax implications of your retirement savings can significantly impact your overall financial health. In Canada, the tax advantages of different savings accounts can either help or hinder your retirement planning. It’s crucial to grasp how taxes apply to your savings strategies so that you can maximize the benefits and minimize potential pitfalls along the way.

Tax-Deferred Growth in Registered Accounts

Accounts like the RRSP (Registered Retirement Savings Plan) allow for tax-deferred growth, meaning your investments can appreciate without being taxed until withdrawal. This can lead to a much larger retirement nest egg over time, as you can keep all of your investment gains working for you instead of paying taxes annually. Take advantage of these avenues to enhance your savings strategy.

Understanding Taxation on Withdrawals

Benefits realized during retirement largely depend on how you manage your withdrawals. When you take money out of your registered accounts, such as an RRSP, these amounts are taxed as income. This can lead to a higher tax bracket than you anticipate if not planned correctly.

Plus, many retirees underestimate the cumulative effect of withdrawal taxes on their retirement savings. Understanding that the money withdrawn from your RRSP is fully taxable and can affect not only your total income but also your eligibility for government benefits is vital. Mismanaging withdrawals can lead to unexpected tax bills and reduced cash flow. Therefore, it’s vital to have a well-structured withdrawal strategy in place that considers the tax implications and helps you maintain a comfortable retirement income.

Retirement Planning Tips

Unlike many individuals believe, strategic retirement planning is crucial to ensure you enjoy your golden years without financial worries. Here are some tips to consider:

- Start saving early

- Diversify your investments

- Maximize your RRSP and TFSA contributions

- Consult a financial advisor regularly

Perceiving the importance of a solid plan can make all the difference in securing your financial future.

Setting Realistic Goals

To effectively prepare for retirement, you need to establish realistic goals based on your financial situation, lifestyle expectations, and desired retirement age. Setting achievable benchmarks can motivate you while providing a clear path to your financial objectives.

Regularly Reviewing Your Savings Strategy

One of the most important aspects of effective retirement planning is regularly reviewing your savings strategy. This ensures that your plan aligns with your evolving financial circumstances and market conditions.

Planning for your retirement isn’t a one-time event; it is an ongoing process that requires consistent evaluation and adjustment. Periodic reviews allow you to assess whether your current savings rate is on track to meet your retirement goals and to make necessary changes as your income or financial needs change. Be sure to include considerations for factors like inflation, unexpected expenses, or changes in lifestyle. Staying proactive means you can adjust your strategy to ensure you remain on track for a financially secure retirement.

Summing up

To wrap up, it’s vital for you to recognize that the misconceptions surrounding retirement savings in Canada can significantly impact your financial security. By understanding facts versus myths—such as the belief that government benefits alone will suffice or that it’s too late to start saving—you can make informed decisions about your future. Taking control of your retirement strategy will help you mitigate potential financial pitfalls and ensure a more comfortable and secure lifestyle when the time comes to enjoy your golden years.

FAQ

Q: What are the most common misconceptions about retirement savings in Canada?

A: Many Canadians hold several misconceptions regarding retirement savings. Some of the most common include the belief that CPP (Canada Pension Plan) will be sufficient to support their retirement lifestyle, underestimating how much they need to save, and thinking that retirement savings can wait until later in life. These misconceptions can lead to insufficient planning and unrealistic expectations about retirement income.

Q: How can Canadians better prepare for their retirement savings to avoid these misconceptions?

A: To better prepare for retirement, Canadians should start by setting clear retirement goals and understanding their expected expenses in retirement. It’s vital to estimate how much they will need to sustain their desired lifestyle. Utilizing retirement savings tools like tax-advantaged accounts (such as RRSPs and TFSAs) and seeking advice from a financial advisor can help create a more informed and structured savings plan. Regularly reviewing and adjusting this plan can also ensure that it remains on track as life circumstances change.

Q: Is it too late for those in their 50s or 60s to start saving for retirement?

A: While starting to save later in life presents challenges, it is never too late to begin saving for retirement. Even small contributions can significantly impact long-term savings due to compound interest. Individuals in their 50s or 60s can also consider delaying retirement, working part-time after retirement, or downsizing their homes to free up additional funds for savings. Each little bit saved can enhance their financial readiness for retirement, so it’s crucial to take action rather than to delay.