How To Master Personal Finance – Avoiding Common Pitfalls As A Canadian

Most Canadians struggle with personal finance due to common pitfalls that can derail their financial health. Understanding how to navigate these challenges is imperative for building a secure financial future. In this article, you’ll discover strategies to avoid debt traps, manage your budget effectively, and make informed investment decisions. By implementing these imperative tips, you can take control of your finances, ensuring that you’re on the path to financial mastery. Let’s explore the key steps you can take to enhance your financial literacy and achieve your goals.

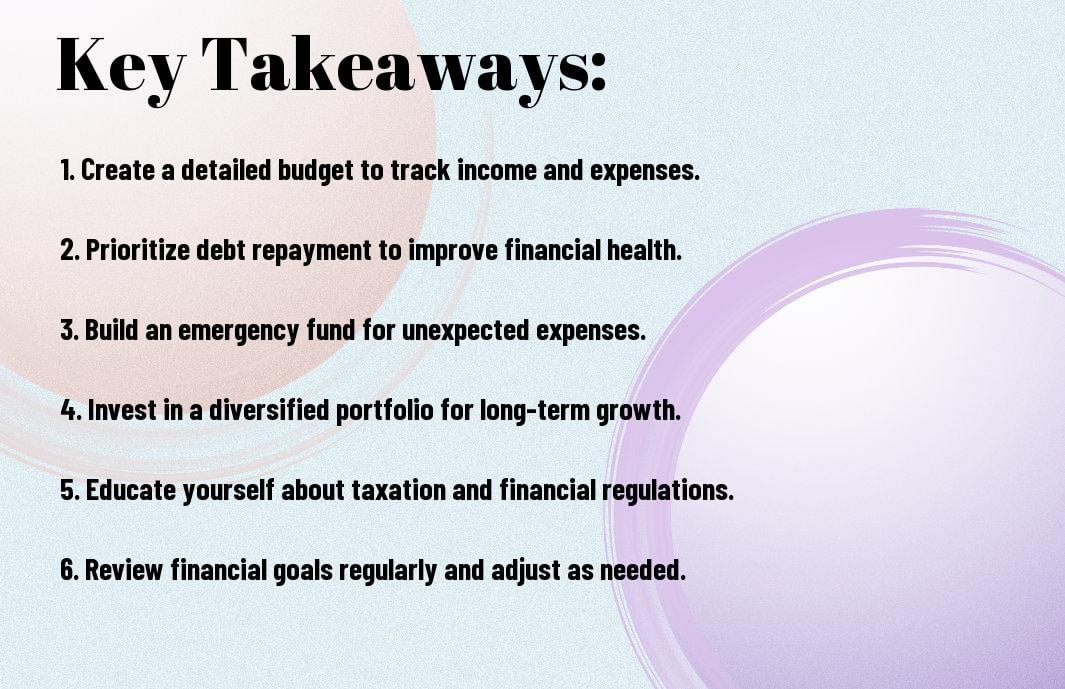

Key Takeaways:

- Budgeting is crucial: Developing a clear budget helps you track your income and expenses, ensuring you live within your means and save for future goals.

- Prioritize debt repayment: Focus on paying off high-interest debt first to reduce financial strain and improve your overall financial health.

- Invest in your future: Start saving and investing early to take advantage of compound interest and ensure long-term financial security.

Understanding Personal Finance

Your journey to mastering personal finance begins with a thorough understanding of your financial landscape. Recognizing the common pitfalls can set you on a path to success, as highlighted in the 5 financial mistakes to avoid when you’re young. By being informed and proactive, you can create a strong financial foundation that will serve you for years to come.

The Importance of Budgeting

An effective budget is vital for managing your finances. It allows you to track your income and expenses, prioritize savings, and identify areas where you can cut back. A well-constructed budget lays the groundwork for achieving your financial goals and helps you avoid unnecessary debt, ultimately fostering financial security.

Key Components of Personal Finance

Budgeting should be one of your primary focuses when addressing personal finance. It serves as the backbone of financial management, guiding your decisions and ensuring you live within your means. In addition to budgeting, understanding savings, investments, and debt management are crucial components. Not only do these elements shape your financial health, but they also empower you to make informed choices that can lead to long-term wealth.

Personal finance encompasses a variety of factors that you must consider to secure your financial future. Each key component—from savings accounts to investment strategies and debt repayment plans—plays a vital role in crafting a balanced financial life. Neglecting any of these aspects can lead to significant risks, such as accumulating high-interest debt or missing out on investment opportunities. Therefore, prioritizing a comprehensive understanding of these components enables you to make informed decisions, ensuring both short-term stability and long-term financial success.

Common Financial Pitfalls

If you want to achieve financial stability, understanding and avoiding common financial pitfalls is crucial. Many Canadians fall into traps that can jeopardize their financial well-being. By recognizing these pitfalls, you can take proactive steps to safeguard your finances and build a more secure financial future.

Overspending and Impulse Buying

Overspending is a prevalent issue that often stems from impulse buying and lack of budgeting. It’s easy to get caught up in the moment and make purchases you didn’t plan for. To combat this, establish a strict budget, track your expenses, and prioritize your needs over wants.

Inadequate Savings and Emergency Funds

Emergency funds are vital for financial security. Without adequate savings, you leave yourself vulnerable to unexpected expenses, such as medical emergencies or car repairs. It is recommended to have at least three to six months’ worth of living expenses saved. This cushion can provide you with peace of mind and prevent debt accumulation in challenging times.

A robust emergency fund acts as a financial safety net that helps you navigate unforeseen circumstances without derailing your financial goals. You should aim to establish a savings habit by setting aside a specific percentage of your income each month until you reach your target amount. This proactive approach can prevent you from resorting to credit cards or loans during emergencies, which may lead to further financial strain.

Debt Management

Now that you understand the significance of managing your finances, it’s crucial to pay close attention to debt management. Failure to effectively handle your debts can lead to long-term financial challenges. By identifying your debt types and adopting strategic methods to reduce them, you can create a solid foundation for future financial stability.

Types of Debt Canadians Face

Now, let’s explore the various types of debt that you, as a Canadian, may encounter:

- Credit card debt

- Student loans

- Personal loans

- Mortgages

- Auto loans

After grasping these common debt types, you can begin to address them effectively.

| Debt Type | Description |

| Credit Card Debt | High-interest debt from unpaid credit card balances. |

| Student Loans | Debt incurred for education purposes, often with lower interest rates. |

| Personal Loans | Unsecured loans for various purposes, often with fixed payments. |

| Mortgages | Loans specifically for purchasing real estate, usually long-term. |

| Auto Loans | Loans taken out for financing vehicles, usually secured by the car. |

Strategies for Paying Down Debt

On your journey to financial freedom, it is necessary to implement effective strategies for paying down your debt. Start by creating a realistic budget that allows you to allocate funds specifically for debt repayment. Prioritize your debts based on their interest rates and focus on paying off the highest-interest debts first. Additionally, consider debt consolidation options that might reduce your total interest payments. Staying disciplined in your repayment strategy will position you well for long-term financial success.

With an array of strategies at your disposal, you can effectively tackle your debts one step at a time. Establishing a debt repayment plan is crucial. Making more than the minimum payments, utilizing the avalanche or snowball methods, and seeking out financial counseling can also help you reclaim financial control. Note, the sooner you confront your debt, the quicker you can achieve your financial goals.

Investing Basics

Not understanding the fundamentals of investing can lead to poor decisions and financial losses. It’s necessary to grasp the core principles, including diversification, time horizon, and compounding interest, which can help you build wealth over time. Taking the time to educate yourself on these topics will empower you to make informed choices and maximize your investments.

Understanding Different Investment Options

An array of investment options exists, ranging from stocks and bonds to mutual funds and ETFs. Each option offers different potential returns, liquidity, and risk levels. By familiarizing yourself with these choices, you can develop a diversified portfolio that aligns with your financial goals and risk tolerance.

The Importance of Risk Assessment

Importance of assessing risk in your investment strategy cannot be overstated. Properly evaluating the level of risk that you can tolerate ensures that your investments will align with your financial goals and personal circumstances. Understanding your risk appetite also helps in making informed decisions about where to allocate your resources.

Risk management is crucial for any investment strategy. By calculating the potential risks associated with various assets, you safeguard your investment portfolio against unexpected market fluctuations. A carefully assessed risk tolerance allows you to pursue higher returns while maintaining peace of mind. Note, balancing risk and return is fundamental in achieving your long-term financial objectives.

Retirement Planning

All Canadians need to prioritize retirement planning to secure their financial future. It’s crucial to start early, understand your goals, and make informed decisions about how you will fund your lifestyle in retirement. By avoiding common pitfalls, such as under-saving or relying solely on government pensions, you can create a robust plan that suits your personal needs and aspirations.

Retirement Savings Accounts in Canada

Planning for retirement in Canada involves taking full advantage of various savings accounts. Utilizing options like the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA), you can maximize your savings potential while minimizing your tax burden. These accounts play a crucial role in building your retirement fund and ensuring you have enough to maintain your lifestyle.

Calculating Your Future Needs

Calculating your future needs is vital to creating a successful retirement strategy.

To ensure you have the funds necessary for a comfortable retirement, you must carefully consider your future lifestyle and expenses. Start by estimating your desired retirement age, projected lifespan, and potential healthcare costs. Additionally, it’s important to factor in inflation and your expected lifestyle changes. By crunching these numbers, you’ll gain a clearer picture of how much you need to save and the types of investments that can help you reach that goal, preventing any unpleasant surprises down the road.

Tax Planning Strategies

After understanding the basics of personal finance, it’s imperative to implement effective tax planning strategies. By being proactive, you can minimize your tax burden, maximize your refundable credits, and ensure you meet all Canadian tax obligations. Engaging in tax planning allows you to keep more of your hard-earned money, promoting financial security and growth.

Tax Regulations for Canadians

Canadians are subject to a complex framework of tax regulations, which includes federal and provincial taxes. Understanding the different rates, exemptions, and deductions available to you is crucial for effective tax planning. Staying informed about deadlines and changes in tax law ensures you remain compliant while optimizing your financial strategy.

Maximizing Tax Benefits

On your journey to master personal finance, maximizing your tax benefits is vital for maintaining your wealth. By utilizing tax-free savings accounts (TFSAs) and registered retirement savings plans (RRSPs), you can enhance your potential returns while lowering your taxable income. This can result in significant long-term savings.

To maximize your tax benefits, consider contributing to an RRSP as contributions can reduce your taxable income, leading to lower taxes owed. Additionally, ensure you take full advantage of tax credits, such as the Canada Worker Benefit and the GST/HST credit. Pay attention to the opportunities for carrying forward unused credits or deductions, and keep thorough records of your expenses. By staying informed and proactive, you will not only reduce your tax liabilities but also enhance your overall financial health.

To wrap up

Hence, mastering personal finance in Canada requires you to be aware of and avoid common pitfalls, such as overspending, neglecting savings, and ignoring debt management. By developing a clear budget, establishing an emergency fund, and investing wisely, you can build a solid financial foundation. Stay informed about financial products and best practices, and regularly review your financial goals. With dedication and the right strategies, you will achieve financial stability and confidence in your personal financial journey.

Q: What are some common pitfalls Canadians face when managing personal finances?

A: Canadians often encounter several common pitfalls in personal finance management. One major issue is underestimating expenses. Many individuals create budgets but overlook irregular expenses such as vehicle maintenance or annual subscriptions, leading to financial strain. Another pitfall is relying too heavily on credit. High-interest debt can accumulate quickly if individuals do not keep track of their credit card spending. Lastly, many Canadians fail to invest early. The power of compound interest means that starting to invest at a young age can lead to significant financial growth over time, but procrastination can derail this potential.

Q: How can Canadians effectively create a budget to avoid financial pitfalls?

A: To effectively create a budget, Canadians should start by tracking their income and all expenses for at least a month. This practice helps identify spending patterns. Next, categorize expenses into fixed (like rent or mortgage) and variable (like dining out), allowing for a clearer view of where adjustments can be made. Implement the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Lastly, review and adjust the budget regularly to account for lifestyle changes or unexpected expenses, ensuring that financial goals stay on track.

Q: What strategies can Canadians implement to avoid high-interest debt?

A: Canadians can employ several strategies to avoid accumulating high-interest debt. First, they should build an emergency fund to cover unexpected expenses, preventing reliance on credit cards. It’s also vital to make timely payments on existing debts to avoid interest accumulation and penalty fees. Using cash for discretionary spending can diminish the temptation to overspend on credit. Additionally, consider using a credit card that offers rewards or cashback, but only if you can pay the balance in full each month. This practice can prevent high-interest charges while still benefiting from the convenience of credit.