Understanding The Canadian Retirement Landscape – Common Mistakes To Sidestep

Canada has a unique retirement landscape that presents both opportunities and challenges for you as you plan for your future. Understanding this landscape is crucial to avoid making common mistakes that could jeopardize your financial security. You need to be aware of issues such as underestimating expenses and failing to account for inflation. By establishing a comprehensive strategy and recognizing potential pitfalls, you can ensure a comfortable retirement. For more insights, check out How Wealthica Can Help You Avoid Financial Mistakes.

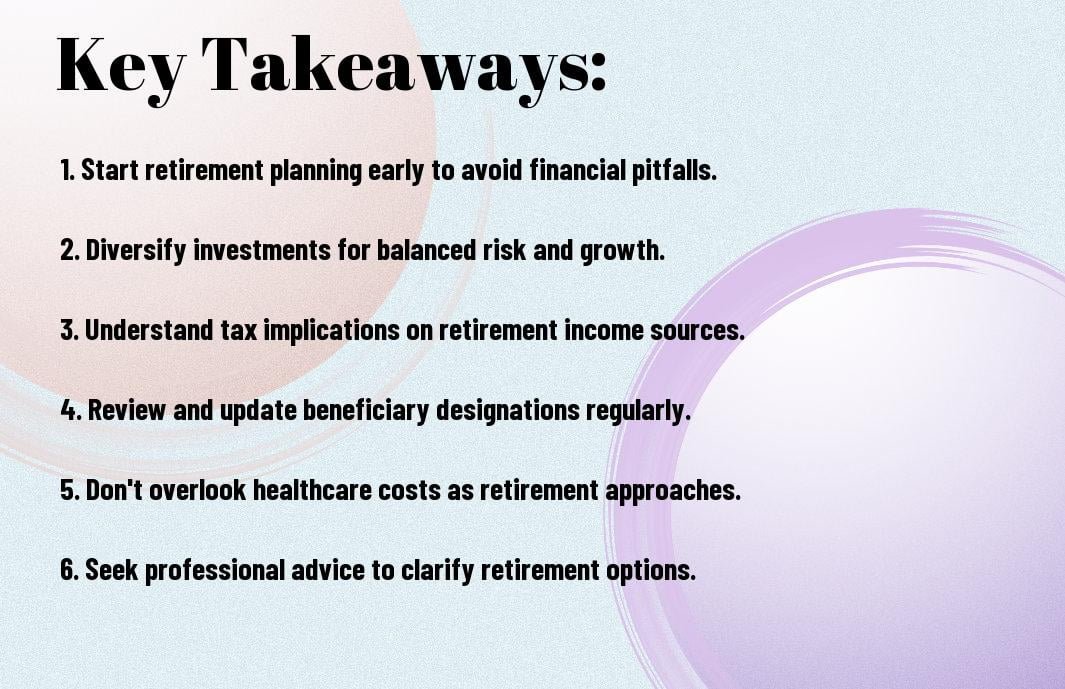

Key Takeaways:

- Planning Ahead: Many Canadians underestimate the importance of early preparation, leading to financial instability in retirement. It’s crucial to start saving as early as possible to secure a comfortable future.

- Diverse Investment Strategy: Relying solely on one source of retirement income, such as CPP or an employer pension, can be risky. A balanced approach that includes a mix of investments can provide greater security.

- Understanding Tax Implications: Failing to comprehend the tax consequences of retirement withdrawals can lead to unexpected financial burdens. It’s necessary to strategize withdrawals for optimal tax efficiency.

Overview of the Canadian Retirement System

A comprehensive understanding of the Canadian retirement system is imperative for your financial security. It integrates various elements, such as personal savings, employer plans, and government support. For insights on effectively navigating this landscape, check out Navigating the New Retirement Landscape: A Guide for Savvy Planners. Knowing these components will prepare you for a comfortable retirement.

Key Components of Canadian Retirement Savings

The Canadian retirement savings landscape consists of three key pillars: the Canada Pension Plan (CPP), Old Age Security (OAS), and personal savings through Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs). Each pillar plays a vital role in shaping your financial future, and understanding how they work together is crucial for effective planning.

Government Benefits and Their Impact

An integral part of preparing for retirement is understanding government benefits that can significantly influence your financial situation. The Canada Pension Plan (CPP) and Old Age Security (OAS) can provide a stable income stream, yet their adequacy relies on your contributions and eligibility.

It is vital to realize that your retirement income from government benefits may not cover all your expenses. While both CPP and OAS are valuable, they usually don’t provide sufficient funds for a comfortable lifestyle. Therefore, you must supplement these benefits through personal savings and investments. Not knowing this could lead to financial strain in your retirement years, making it imperative for you to evaluate your expected income and expenses to ensure a sustainable financial plan. Understanding these aspects will empower you to make informed decisions for your future.

Common Mistakes in Retirement Planning

It’s easy to overlook critical aspects of retirement planning that can lead to significant financial shortfalls later in life. Many individuals fall into common traps that can be easily sidestepped with proper preparation and foresight. By understanding these missteps, you can enhance your retirement strategy and ensure a more stable financial future.

Underestimating Retirement Expenses

Underestimating your retirement expenses can be a costly mistake. Many people fail to account for rising living costs, healthcare, and unforeseen emergencies, resulting in a tight budget during retirement years.

Overlooking Tax Implications

With retirement savings, taxes can be an afterthought, yet overlooking tax implications can deplete your funds faster than you realize.

The money you withdraw from your retirement accounts can be subject to higher tax rates, which might catch you off guard. For instance, RSP withdrawals are fully taxable in the year they are taken, and an unexpected spike in your taxable income can push you into a higher tax bracket. Moreover, capital gains tax applies to investments sold in taxable accounts, affecting your net retirement income. Planning for these taxes is crucial as they can significantly diminish your retirement savings. By being proactive and speaking with a financial planner about tax-efficient strategies, you can protect your wealth and maximize your income during retirement.

Importance of Diversifying Your Retirement Portfolio

Not diversifying your retirement portfolio can expose you to significant financial risks. A well-rounded investment strategy, which includes a mix of assets such as stocks, bonds, and real estate, helps cushion your savings against market volatility. By spreading your investments across various asset classes, you can better protect your retirement nest egg and potentially enhance your overall returns. Do not forget, a diversified portfolio is your best defense against economic downturns and unexpected financial crises.

Asset Allocation Strategies

Strategies for asset allocation involve determining the right mix of investments based on your risk tolerance, financial goals, and time horizon. It is vital to regularly review and adjust your allocations to reflect changes in your circumstances, market conditions, and investment performance. By finding the perfect balance, you can create a robust portfolio that supports your retirement aspirations while minimizing unnecessary risks.

Balancing Risk and Rewards

To effectively balance risk and rewards in your retirement portfolio, you need to consider the relationship between the potential return of an investment and the risks associated with it. This may involve selecting a range of asset types that align with your financial goals and risk tolerance, allowing you to seek higher returns while managing exposure to market volatility.

Balancing risk and rewards in your portfolio is vital for achieving your retirement goals. Too much risk can lead to devastating losses, while being overly conservative might not provide the growth needed for a comfortable retirement. You need to assess your investment horizon and personal circumstances when determining your risk appetite. A balanced approach may include a mix of equities for growth potential and fixed income investments for stability. Regularly revisiting your strategy and adjusting your portfolio based on performance and market conditions is crucial in ensuring that you’re on track to meet your retirement objectives.

Timing Your Retirement: What to Consider

To ensure a smooth transition into retirement, consider the optimal timing based on both your personal and financial circumstances. Your decision should be influenced by factors such as your lifestyle goals, financial security, and the overall economic climate. Conducting a thorough analysis can help you sidestep common pitfalls that may arise from premature or delayed retirement planning.

Factors Influencing Retirement Timing

The timing of your retirement is crucial and can be influenced by several key factors including:

- Financial readiness

- Desired lifestyle

- Health status

- Social security benefits

- Market conditions

Knowing how these elements interplay can empower you to make informed decisions that align with your retirement aspirations.

The Role of Healthcare in Retirement Decisions

Influencing your retirement decisions significantly, healthcare costs can be a major concern. As you age, you might face increasing medical expenses that can strain your retirement savings. It’s necessary to consider your healthcare options, such as private insurance, provincial health plans, and long-term care. Retirement planning should include a detailed strategy to manage these potential costs, as overlooking them can lead to financial hardship.

Retirement planning must take into account the impact of healthcare costs on your financial security. With medical expenses often rising faster than inflation, it’s vital to incorporate a thorough assessment of insurance coverage and potential out-of-pocket expenses into your budget. Moreover, ensuring access to quality care can provide peace of mind during your retirement years. Recognizing healthcare’s role today can safeguard your future and enhance your overall quality of life in retirement.

The Significance of Professional Guidance

After navigating through the complexities of retirement planning, many individuals find themselves overwhelmed by the myriad of options and potential pitfalls. Seeking professional guidance can significantly enhance your understanding of the Canadian retirement landscape, enabling you to make informed decisions. Financial advisors provide expertise, help you avoid common mistakes, and tailor a strategy that aligns with your unique financial situation and long-term goals.

Benefits of Working with Financial Advisors

Working with financial advisors offers numerous advantages, including personalized advice, risk assessment, and access to a broader range of investment opportunities. They can clarify complicated concepts, help you develop a comprehensive retirement plan, and provide ongoing support to navigate any changes in your financial circumstances. Their insights can significantly improve the likelihood of achieving your retirement goals while minimizing stress during the process.

Choosing the Right Advisor for Your Needs

One critical step in ensuring a successful retirement plan is choosing the right advisor for your unique financial landscape. A good match can make a considerable difference in how effectively you reach your retirement goals.

For instance, consider your specific requirements, such as financial knowledge, investment strategy, and service offerings. Assess whether the advisor specializes in retirement planning, as this can yield more tailored solutions for your needs. Also, verify their qualifications and credentials to ensure you’re working with a knowledgeable professional. Don’t hesitate to discuss fees and compare multiple advisors to understand what you’re getting for your money. The right advisor can be your greatest ally in creating a secure financial future.

Strategies for a Successful Retirement Transition

Now is the time to focus on effective strategies for transitioning into retirement. A smooth shift can significantly affect your overall satisfaction and financial stability in retirement. By planning ahead and implementing key strategies, you can sidestep common pitfalls and ensure a fulfilling post-retirement life.

Emotional and Psychological Preparedness

One of the most overlooked aspects of retirement is emotional and psychological readiness. It’s crucial to understand that your identity might shift once you leave the workforce. Preparing mentally for this change will help you adapt and enjoy your newfound freedom, ensuring that you are not just financially, but also emotionally ready for this significant life stage.

Creating a Robust Post-Retirement Plan

For a successful retirement, you must create a robust post-retirement plan that encompasses more than just finances. Addressing hobbies, social engagements, and potential part-time work can significantly improve your quality of life in retirement.

With a solid post-retirement plan, you can navigate the complexities of this new phase in your life. It’s vital to include financial goals, personal interests, and social connections to ensure a well-rounded experience. Moreover, engaging in community activities or volunteering can provide a sense of purpose and belonging, greatly enhancing your emotional health. Strong planning ultimately empowers you to embrace this new chapter with enthusiasm and confidence.

To wrap up

Hence, by understanding the Canadian retirement landscape and being aware of common mistakes to sidestep, you can ensure a more secure and comfortable future. Recognizing the importance of proper planning, saving diligently, and making informed investment choices will empower you to make the most of your retirement years. Take the time to review your financial strategies and seek professional advice when necessary, so you can navigate this crucial phase of life with confidence and clarity.

FAQ

Q: What are some common mistakes Canadians make when planning for retirement?

A: One of the most common mistakes is underestimating the amount of savings needed for retirement. Many Canadians forget to account for factors like inflation, healthcare costs, and unexpected expenses that may arise later in life. Additionally, failing to start saving early can greatly impact the overall retirement fund, as the benefits of compound interest increase significantly over time. Lastly, neglecting to diversify investments can lead to missed opportunities for growth and increased risk with a portfolio concentrated in one area.

Q: How can Canadians effectively prepare for unexpected expenses during retirement?

A: Canadians can prepare for unexpected expenses by creating a comprehensive retirement budget that includes a cushion for emergencies. It’s also advisable to maintain an emergency fund that can cover 3 to 6 months’ worth of living expenses, separate from retirement savings. Furthermore, exploring health insurance options or a long-term care insurance plan can provide extra peace of mind in case of high medical costs. Lastly, regularly reviewing and adjusting the retirement plan according to changing financial situations can help manage potential surprises.

Q: What role do government programs play in the Canadian retirement landscape?

A: Government programs such as the Canada Pension Plan (CPP) and Old Age Security (OAS) play a crucial role in providing financial support to retirees. The CPP offers benefits based on individual contribution history, while OAS provides a basic income to eligible seniors. Canadians should understand how these programs work and how they fit into their overall retirement strategy. It’s important to be aware of the age at which one should start drawing these benefits, as starting too early or too late can affect the total amount received. Moreover, individuals should be proactive in ensuring their contributions are up to date, allowing them to maximize their benefits upon retirement.