Reinblatt Financial's Tips On Navigating The Biggest Financial Mistakes

Just when you think you have your finances under control, unexpected mistakes can derail your plans. Understanding the biggest financial pitfalls is crucial for anyone looking to secure their financial future. In this post, we’ll share valuable insights that will help you avoid costly errors and make informed decisions. By recognizing these dangerous financial missteps, you can enhance your financial literacy and protect your hard-earned money. For a deeper look into common mistakes, check out 10 Big Mistakes These Financial Experts Recommend ….

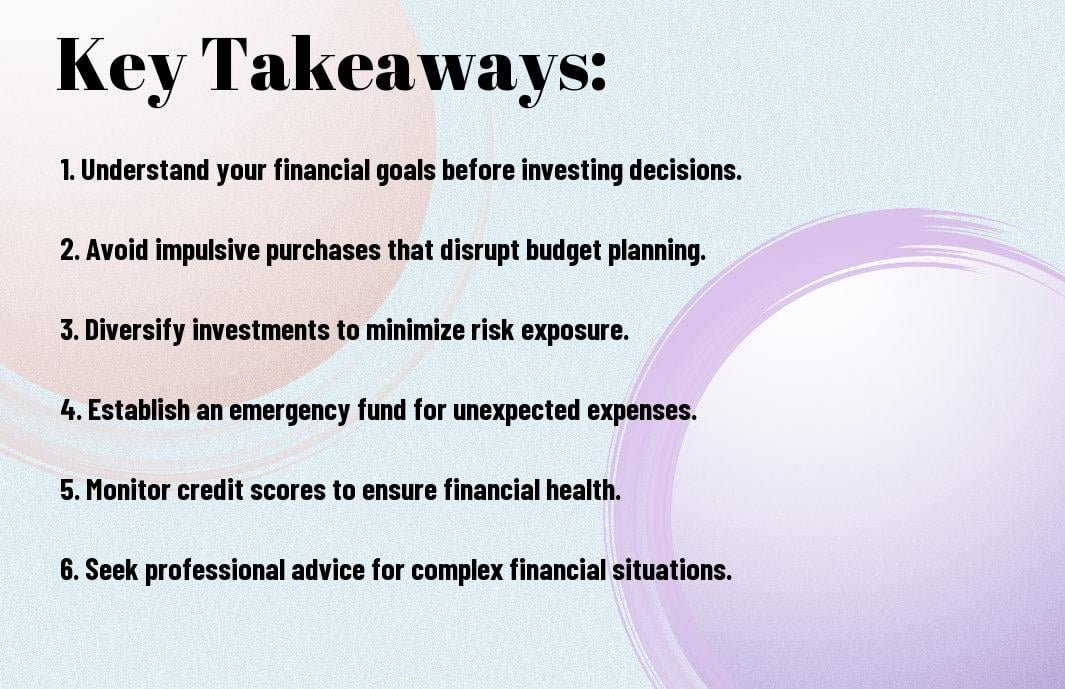

Key Takeaways:

- Budgeting Essentials: Create and maintain a realistic budget that accounts for all expenses to prevent overspending.

- Avoid Impulse Purchases: Make informed financial decisions by taking time to consider purchases, reducing the likelihood of regret later.

- Invest Smartly: Diversify investments and educate yourself about the market to minimize risks and maximize returns.

Understanding Common Financial Mistakes

While navigating your financial journey, it’s crucial to recognize the most common mistakes that can hinder your progress. These missteps often stem from poor decision-making and lack of awareness, which can lead to significant long-term consequences. By understanding these pitfalls, you can develop strategies to avoid them and achieve your financial goals more effectively.

Overspending and Impulse Buying

Buying items on a whim can rapidly deplete your savings and lead to unnecessary debt. When you indulge in impulse purchases, you often overlook your financial priorities, leading to buyer’s remorse and regret. Instead, practice mindful spending by assessing your needs versus wants and creating a strategy to avoid falling into the overspending trap.

Neglecting Budgeting and Financial Planning

Financial planning is crucial for maintaining control over your finances. Without a solid budget, you risk losing sight of your financial goals and can easily accumulate debt. Neglecting to allocate resources towards savings and investments may limit your ability to handle emergencies or seize opportunities that arise. By prioritizing a comprehensive budget and regularly reviewing your financial strategies, you can create a clearer path toward your future.

The key to successful financial planning lies in developing a well-structured budget that reflects your income, expenses, and savings goals. This discipline not only increases your awareness of your spending habits but also ensures you have a plan to address unexpected costs effectively. To achieve lasting financial stability, remember to regularly review and adjust your budget according to your changing needs and goals. Embrace this proactive approach and empower yourself to make informed and beneficial financial decisions.

The Importance of Emergency Funds

Little can be more stressful than facing an unexpected financial crisis without a safety net. Establishing an emergency fund is crucial for ensuring that you can handle unexpected expenses, such as medical emergencies or car repairs, without derailing your financial stability. By prioritizing this fund, you empower yourself to navigate life’s uncertainties with confidence and resilience.

How Much to Save

To determine how much you should save in your emergency fund, aim for three to six months’ worth of living expenses. This range provides a solid cushion to cover necessary costs like housing, food, and healthcare during unforeseen financial hardships. Assess your monthly expenses carefully, and adjust your savings goal as your financial situation evolves.

Accessible and Liquid Accounts

Accounts that prioritize accessibility and liquidity are necessary for your emergency fund. You want to ensure that you can easily access your funds without incurring penalties or delays. Consider high-yield savings accounts or money market accounts that offer competitive interest rates while remaining easily withdrawable in times of need.

Emergency funds should be kept in accessible and liquid accounts, enabling you to retrieve your money swiftly when emergencies arise. This accessibility minimizes the temptation to dip into your savings for non-emergencies, preserving the fund’s integrity. It’s vital to choose accounts that have low fees and allow hassle-free withdrawals, ensuring that your money is readily available when you need it most.

Investing Wisely

Many investors struggle with the temptation to chase trends or make impulsive decisions based on market fluctuations. To secure your financial future, it is vital to approach investing with a clear strategy, ensuring that your choices are informed and aligned with your long-term goals. Wise investing involves conducting thorough research, being aware of your risk tolerance, and continuously monitoring your portfolio. By doing so, you can avoid common pitfalls and enhance your chances of building wealth over time.

Diversification Strategies

Investing in a diversified portfolio is crucial for mitigating risks. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can protect your portfolio from market volatility. A well-balanced mix not only helps in reducing potential losses but also positions you for consistent returns, allowing you to take advantage of different market conditions.

Avoiding Emotional Investing

On the path to successful investing, it is crucial to avoid letting your emotions dictate your decisions. Strong feelings, whether fear during market downturns or excitement during rallies, can lead to rash actions that jeopardize your financial goals. By remaining disciplined and adhering to a structured investment plan, you can mitigate these risks and focus on achieving long-term success.

Strategies for avoiding emotional investing include setting clear, well-defined investment goals that guide your choices, and practicing mindfulness to recognize emotional triggers that may influence your decisions. It’s also vital to adhere to your investment plan despite market fluctuations, and establish automatic investment contributions to limit impulsive moves. By maintaining a rational mindset and relying on research-driven information, you can navigate the complexities of investing and significantly increase your chances of financial success.

Managing Debt Effectively

Now that you’ve identified the importance of managing your finances, it’s crucial to develop strategies that keep your debt under control. Effective debt management can help you avoid financial distress and enable you to enjoy a more stable financial future. Prioritizing payments and understanding the types of debt you carry can set you on the right path towards financial freedom.

Strategies for Reducing High-Interest Debt

Any debt, especially high-interest debt, can become a financial burden if not managed properly. Consider strategies such as creating a monthly budget, using the debt snowball or avalanche methods, and consolidating loans. By making consistent payments and prioritizing your debts, you can significantly lower your total interest payments and achieve greater financial peace of mind.

Understanding Credit Scores

One of the most impactful elements in your financial life is your credit score. This three-digit number reflects your creditworthiness to lenders and influences your ability to secure loans at favorable terms. Understanding how your credit score is calculated, including the importance of timely payments and credit utilization, equips you with the knowledge to build and maintain a healthy credit profile.

Debt plays a crucial role in your credit score, as it comprises about 30% of the calculation. Maintaining a low credit utilization rate—ideally below 30%—can positively impact your score. Late payments or defaults, on the other hand, could drastically lower your score and hinder your borrowing potential. Regularly monitoring your credit report and disputing any inaccuracies can help you manage your credit score effectively, ensuring you have access to favorable lending options when you need them.

Retirement Planning Essentials

Unlike many financial goals, retirement planning requires a long-term strategy and careful consideration of your future needs. Understanding how much you’ll need to retire comfortably, starting early, and making informed choices about investment vehicles are crucial steps. By prioritizing these importants, you can build a sustainable retirement plan that allows you to enjoy your golden years without financial stress.

Starting Early vs. Catching Up

On the surface, starting early on your retirement savings seems to yield the best benefits, thanks to the power of compound interest. However, life circumstances often lead some people to start later. If you find yourself needing to catch up, it’s vital to calculate your needed savings and possibly adjust your contributions or investment strategy to achieve your retirement goals.

Choosing the Right Retirement Accounts

Any retirement account you select can significantly impact your savings potential and tax liabilities. Options include traditional IRAs, Roth IRAs, and employer-sponsored 401(k)s, each with its own set of benefits and limitations. Your choice should align with your financial situation and retirement timeline.

Starting your journey toward choosing the right retirement accounts involves understanding the unique advantages of each type. For example, a traditional IRA allows for tax-deductible contributions but taxes withdrawals in retirement, while a Roth IRA provides tax-free withdrawals but has limitations on upfront tax breaks. Meanwhile, a 401(k) may include employer matching contributions that can significantly boost your savings. Carefully assessing your income, tax bracket, and retirement goals will guide you in selecting the accounts that best suit your needs, maximizing your growth potential and ensuring you’re well-prepared for retirement.

Seeking Professional Financial Advice

To successfully navigate financial challenges, seeking professional financial advice can be invaluable. Professionals can offer tailored solutions and strategies that align with your unique goals and circumstances. Leveraging expertise from reputable sources like Reinblatt Financial – Bringing your future into the present can help you avoid common pitfalls and make informed decisions that enhance your financial well-being.

When to Consult a Financial Advisor

On certain occasions, such as during major life changes, significant financial decisions, or investment opportunities, consulting a financial advisor is crucial. When you feel overwhelmed by financial choices or lack the expertise to optimize your investments, reaching out for professional guidance can save you time and money while maximizing your potential for success.

Finding the Right Professional for You

An crucial step in your financial journey is finding the right professional who aligns with your needs and values. Research potential advisors and vet their qualifications, expertise, and client reviews to ensure you’re making an informed decision. Look for a proactive advisor that prioritizes transparency and maintains a personalized approach to financial planning.

It is critical that you take the time to ensure the advisor you choose possesses the right credentials, so you can avoid inexperienced practitioners who may lead you astray. Focus on selecting an advisor with strong references and a solid reputation to provide you with the best guidance. Moreover, consider how well they communicate and understand your financial goals, as a good fit can result in a long-term, trusting relationship that ultimately enhances your financial success.

Conclusion

Taking this into account, navigating financial decisions can be daunting, but avoiding the most common financial mistakes is imperative for securing your financial future. By applying Reinblatt Financial’s tips, you can enhance your budgeting, invest wisely, and make informed choices that align with your goals. Do not forget, staying informed and proactive will empower you to take control of your finances, leading to greater stability and confidence in your financial journey.

FAQ

Q: What are some common financial mistakes that individuals make?

A: Common financial mistakes include failing to create and stick to a budget, ignoring the importance of an emergency fund, and accumulating high-interest debt. Additionally, many people underestimate the benefits of long-term investments and often make emotional decisions when it comes to spending. Reinblatt Financial recommends being proactive about your financial planning by setting clear goals and regularly reviewing your financial status.

Q: How can I avoid falling into the trap of high-interest debt?

A: To avoid high-interest debt, it is crucial to manage credit cards and loans wisely. Start by creating a budget to monitor your monthly expenses and income. Pay down existing debt, focusing on high-interest accounts first, and avoid using credit for non-imperative purchases. Reinblatt Financial also advises setting a specific savings goal, so you’re less likely to rely on credit when unexpected expenses arise.

Q: What steps can I take to improve my financial literacy?

A: Improving financial literacy is imperative for making informed decisions. Begin by educating yourself through financial blogs, books, and courses that cover topics like budgeting, investing, and retirement planning. Following trusted financial advisors like Reinblatt Financial can provide you with valuable insights and tips. It’s also helpful to join online forums or local workshops where you can share experiences and learn from others.