Smart Strategies For Canadians – Building Wealth Without Breaking The Bank

You have the power to transform your financial future by utilizing smart strategies tailored for your unique Canadian circumstances. In this blog post, we will explore effective and sustainable ways to build wealth without overwhelming your budget. You’ll learn how to leverage investing, savings tactics, and budgeting techniques that can help you achieve your financial goals while maintaining your peace of mind. Discover how you can make informed decisions to enhance your wealth and secure a prosperous future for yourself and your family.

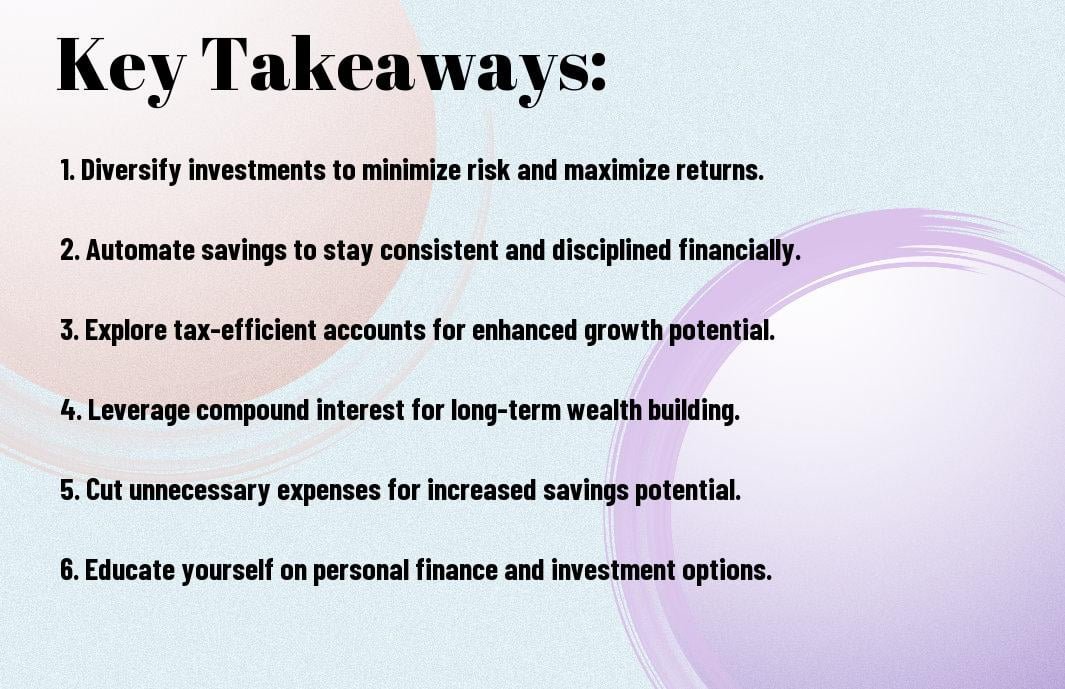

Key Takeaways:

- Budgeting Wisely: Establishing a detailed budget is crucial for tracking expenses and savings, enabling Canadians to allocate funds effectively towards wealth-building goals.

- Diversifying Investments: Spreading investments across various asset classes reduces risk and can enhance overall returns, making it a smart strategy for long-term financial growth.

- Utilizing Tax Benefits: Taking advantage of Canadian tax-efficient accounts, such as RRSPs and TFSAs, can significantly impact savings and investment growth, helping Canadians maximize their wealth without overspending.

Understanding Wealth Building

The journey to wealth building is a nuanced process that involves discipline, education, and strategic planning. By incorporating smart financial habits, such as saving, investing, and minimizing debt, you can set yourself on a path to financial success without sparing excessive resources. For insights on turning your aspirations into reality, tune into the Canadian Wealth Secrets | Podcast on Spotify.

Defining Wealth

Defining wealth goes beyond monetary accumulation; it’s about achieving financial freedom that enhances your quality of life. Wealth may include factors like assets, investments, and the ability to pursue your passions, ultimately leading to a rewarding lifestyle. You must consider what wealth means personally to you, as it varies from individual to individual.

The Importance of Financial Literacy

An understanding of financial literacy is crucial for anyone looking to build wealth. It empowers you to make informed decisions regarding budgeting, saving, investing, and comprehending the financial markets. Without this knowledge, you risk falling prey to poor financial choices or scams, jeopardizing your financial health.

Understanding financial literacy equips you with the tools to manage your money effectively, avoid debt traps, and create a sustainable wealth-building strategy. It involves grasping core concepts of investments, credit, and financial planning. Gaining this knowledge allows you to navigate challenges and seize opportunities that lay the groundwork for long-term financial security and prosperity.

Budgeting Basics

Little changes in your financial habits can lead to significant savings over time. Establishing a budget is fundamental to building your wealth without overspending. For a deeper look into financial strategies for Canadians, check out the Guide to Building Wealth : r/PersonalFinanceCanada.

Creating a Realistic Budget

On your journey to financial health, creating a realistic budget is necessary. Start by tracking your income and expenses to understand where your money is going. Identify non-necessary expenses you can cut back on and allocate funds toward savings and investments. Be mindful of, a flexible budget is more sustainable over the long term.

Tools and Apps for Budget Management

The right tools can enhance your budgeting experience significantly. Mobile apps like Mint, You Need a Budget (YNAB), and PocketGuard allow you to monitor your spending, set financial goals, and visualize your budget, all from your smartphone. These platforms often include helpful notifications and reports that keep you informed about your financial status.

Management of your budget becomes much simpler with the use of budgeting apps. These tools not only track your spending but can also help you identify hidden costs and areas for improvement. Prioritize those that offer budget creation, expense tracking, and goal-setting features. With their real-time updates, they empower you to make informed financial decisions and reinforce positive spending habits. However, ensure you choose a secure app to protect your sensitive financial data as you work towards effective budget management.

Saving Strategies

Once again, adopting effective saving strategies is crucial for Canadians looking to build wealth without draining their finances. By establishing a savings plan that prioritizes your financial goals, you can significantly enhance your financial health while still managing daily expenses. Consider focusing on emergency funds, high-interest savings accounts, and budgeting techniques tailored to your lifestyle for a balanced approach to saving.

Emergency Funds: Why They Matter

Matter of fact, having an emergency fund can be a financial lifesaver. This safety net allows you to cover unexpected expenses—such as medical bills or car repairs—without derailing your budget or incurring debt. Aim for three to six months’ worth of living expenses saved in a separate, easily accessible account. This proactive step not only provides peace of mind but also protects your long-term financial goals.

High-Interest Savings Accounts

To maximize your savings growth, consider utilizing high-interest savings accounts. These accounts typically offer better interest rates compared to standard savings accounts, allowing your money to grow more effectively over time. While it may seem minor, the difference in interest rates can lead to significant gains on your savings.

Plus, high-interest savings accounts often come with fewer restrictions than other investment options, making them an excellent choice for your short-term savings goals. Alongside the potential for higher interest, they are typically low-risk and easily accessible. However, always compare different accounts, as some may have hidden fees that can eat into your savings. Look for accounts with no monthly fees or minimum balances to maximize your returns and ensure your hard-earned money is working as efficiently as possible.

Investing Wisely

Many Canadians are looking for ways to increase their wealth, and investing wisely is a significant part of that strategy. By understanding the various avenues available, you can make informed decisions that align with your financial goals. Investing doesn’t have to be complicated or require vast sums of money; starting small and remaining disciplined can lead to substantial growth over time.

Basics of the Stock Market

The stock market is a platform where you can buy and sell ownership in publicly traded companies. Understanding how the stock market works is crucial for your investment success. You can trade stocks through brokerage accounts and benefit from price fluctuations, dividends, and long-term capital gains. By educating yourself on market trends and company performance, you can make strategic decisions that boost your portfolio.

Real Estate Investment for Beginners

Beginners often find real estate investment appealing due to its potential for generating passive income and long-term appreciation. While it requires initial capital, the returns can be significant if managed properly. Understanding the local market trends and property valuation is imperative to ensure you make sound investment choices.

To successfully navigate real estate investment as a beginner, you should start by researching property locations, understanding financing options, and considering comparable properties. Networking with experienced investors can provide invaluable insights, and investing in rental properties can yield stable cash flow. However, be aware of the risks, such as maintaining the property and potential market downturns, and always assess your ability to handle these factors before committing. Your decision-making process should involve due diligence to protect your investments.

Utilizing Government Programs

Now is the time to take full advantage of the various Canadian government programs designed to help you build wealth efficiently. By understanding and utilizing these programs, you can enhance your financial strategy without putting additional strain on your budget. From tax-free savings options to retirement planning, these resources can significantly contribute to your financial future while leveraging benefits that suit your unique situation.

Tax-Free Savings Account (TFSA)

On your journey to financial wellness, a Tax-Free Savings Account (TFSA) can be a game changer. This account allows you to save and invest without paying tax on any income earned. The contribution limits change annually, but any unused contribution room carries forward, giving you flexibility. Consider using your TFSA for both short-term and long-term financial goals, ensuring you make the most out of your tax-free savings potential.

Registered Retirement Savings Plan (RRSP)

TaxFree savings can be an effective way to secure your future. With a Registered Retirement Savings Plan (RRSP), your contributions are tax-deductible, meaning you can reduce your taxable income in the year you contribute. Moreover, the income earned within the plan is tax-deferred until withdrawal, which typically occurs in retirement when you may be in a lower tax bracket.

Programs like the RRSP not only help you save for retirement but also allow your investments to grow without the immediate burden of taxes. It’s critical to remember that withdrawing funds before retirement can incur heavy penalties, so maintaining discipline is vital. It’s also advantageous to contribute regularly and take full advantage of any matching plans or employer contributions that may be available. This approach could vastly increase your retirement savings over time, setting you up for a more comfortable and financially secure future.

Avoiding Common Financial Pitfalls

Keep a watchful eye on your spending habits to avoid common financial pitfalls that can derail your wealth-building efforts. By cultivating awareness about where your money goes, you can make informed choices that lead to sound financial health. Establishing a budget, monitoring expenses, and prioritizing needs over wants are effective methods to steer clear of debt and unnecessary costs, ensuring you keep your finances on track.

Debt Management Strategies

One effective way to manage your debt is to prioritize high-interest loans and credit card balances, allocating extra funds towards them first. This strategy, known as the “avalanche method,” minimizes the total interest paid and shortens your debt journey. Additionally, consider consolidating your debts into a single lower-interest loan to simplify payments and reduce monthly obligations.

Understanding Credit Scores

One important aspect of your financial health is understanding your credit score, which plays a crucial role in securing loans and favorable interest rates. Regularly checking your score can empower you to take action if it’s lower than expected, such as disputing errors or improving your credit habits.

Common misconceptions about credit scores can lead to damaging financial consequences. Your score is impacted by factors like payment history, credit utilization, and the length of your credit history. Missing payments can significantly decrease your score, while keeping your credit utilization below 30% can positively influence it. By proactively managing these elements, you not only improve your chances of getting the best rates but also set a strong foundation for your financial future.

Final Words

Drawing together the insights from ‘Smart Strategies For Canadians – Building Wealth Without Breaking The Bank’, you can effectively enhance your financial journey without overspending. By adopting a strategic approach to budgeting, investing wisely, and leveraging available resources, you can maximize your wealth-building potential. Bear in mind, small, consistent actions today can lead to significant financial rewards tomorrow, allowing you to secure a prosperous future while staying within your means. Embrace these strategies as you take control of your financial destiny.

FAQ

Q: What are some smart strategies for Canadians to build wealth without taking on significant debt?

A: Canadians can build wealth without breaking the bank by adopting several key strategies. Firstly, consider maximizing contributions to tax-advantaged accounts such as RRSPs (Registered Retirement Savings Plans) and TFSAs (Tax-Free Savings Accounts). This allows your investments to grow tax-free or tax-deferred. Secondly, focus on creating a diversified investment portfolio that includes a mix of stocks, bonds, and real estate, which can help mitigate risk while maximizing returns. Lastly, living within your means by budgeting and avoiding unnecessary expenses can free up more capital for investments over time.

Q: How can Canadians effectively save for retirement without compromising their financial stability?

A: Effective retirement saving for Canadians involves a disciplined approach to financial planning. Start by establishing clear retirement goals and timelines. Utilize automated savings plans to consistently contribute to your retirement accounts, which can help build a habit of saving. Additionally, consider seeking advice from a financial advisor to ensure your investment strategy aligns with your risk tolerance and goals. Take advantage of employer-sponsored pension plans, if available, and don’t underestimate the power of compound interest—starting early can significantly enhance your retirement savings.

Q: What tools and resources are available for Canadians looking to implement wealth-building strategies?

A: Canadians have access to a variety of tools and resources to aid in their wealth-building journey. Online financial planning tools, such as budgeting apps and investment calculators, can help track and project your financial goals. Many Canadian banks and credit unions offer educational resources and workshops on personal finance and investing. Furthermore, online platforms and robo-advisors provide low-cost investment management services. Additionally, community organizations often host financial literacy programs to empower Canadians with the knowledge needed to make informed financial decisions.