Planning

By Deanne Gage – sunlife.ca If you want to achieve your financial goals, what you do is only part of the story. What you don’t do is just as important. Want to meet your financial planning* goals with few issues? To increase your chances of achieving financial security, avoid these 4 mistakes: 1. Waiting too…

The power of saving early and steadily for the long term can make a great impact on your retirement lifestyle. In this installment of Life & Money Matters Peter shares some thoughts on the benefits of paying yourself first. Transcript: Pay Yourself First Life & Money Matters

Your home is probably the biggest investment you’ll ever make. When you arrange a mortgage with a financial institution, they may ask you if you want to insure your mortgage through them. But mortgage insurance from your bank or mortgage lender may not be your best alternative. Consider Term Life Insurance which is portable to…

Market volatility and increasing expenses can have many retirees concerned whether their retirement income will last as long as they live. In this video segment, Peter discusses four key retirement questions you should consider to help plan for the unexpected. Transcript: Four Retirement Questions for Retirees Life & Money Matters: Four Retirement Questions for Retirees…

By Dr. Loraine Oman-Ganes, MD, FRCPC, CCMG, FACMG, Chief Medical Director, Sun Life Financial Understanding your risk of breast cancer can help you and your doctor prevent it, or find it and treat it. We know vastly more about breast cancer now than we did 15 years ago. This has led to earlier, more precise…

Media headlines and market uncertainty have left many aging investors with the feeling “I’m worried that I won’t have enough”. In this first segment of Life & Money Matters, Peter shares some of the top retirement planning concerns among investors. Transcript: Top Retirement Planning Concerns Life & Money Matters

By Sheryl Smolkin – brighterlife.ca Does your T4 say you made more than you thought you did? Perhaps you didn’t consider your taxable benefits. Find out what is and isn’t taxable. When you get your T4 slip in January or February, you may wonder why the employment income reported in Box 14 is higher than…

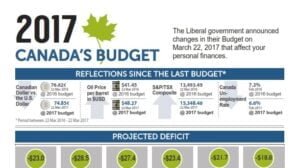

The new Liberal government announced changes in their budget in March, 2017 that affect your personal finances. PDF Version

An option to consider – the Corporate Insured Retirement Program with Corporate Borrowing With this financial planning strategy, your corporation deposits funds into a permanent life insurance policy in excess of the amount required to cover the insurance and other policy costs. In the future, your corporation assigns the policy to the bank as collateral…

By Kim Armstrong – sunlife.ca Job insecurity doesn’t have to mean financial insecurity. These 5 tips will help you improve your financial health and plan for a brighter future. Sophia Erikson is a 26-year-old who, for the past 2 years, has had to live away from her family and friends, moving from one contract job…